The Hidden Signs of a Dying Business: What Wall Street Won't Tell You

#39 A Young Professionals Weekly Investing Insights

What if you could spot a failing business before your portfolio takes a hit?

After analysing over 200 business failures - from retail giants to tech darlings - I've uncovered a pattern that could save your hard-earned money.

The best part?

You don't need to be a Wall Street analyst to spot these patterns.

You just need to know where to look.

Why Most Investors Miss the Warning Signs

Here's a surprising truth: 90% of business failures showed clear warning signs up to 24 months before their collapse.

Yet most investors miss them because they're looking at the wrong things.

They focus on quarterly earnings reports and stock prices - while the real story is hiding in plain sight.

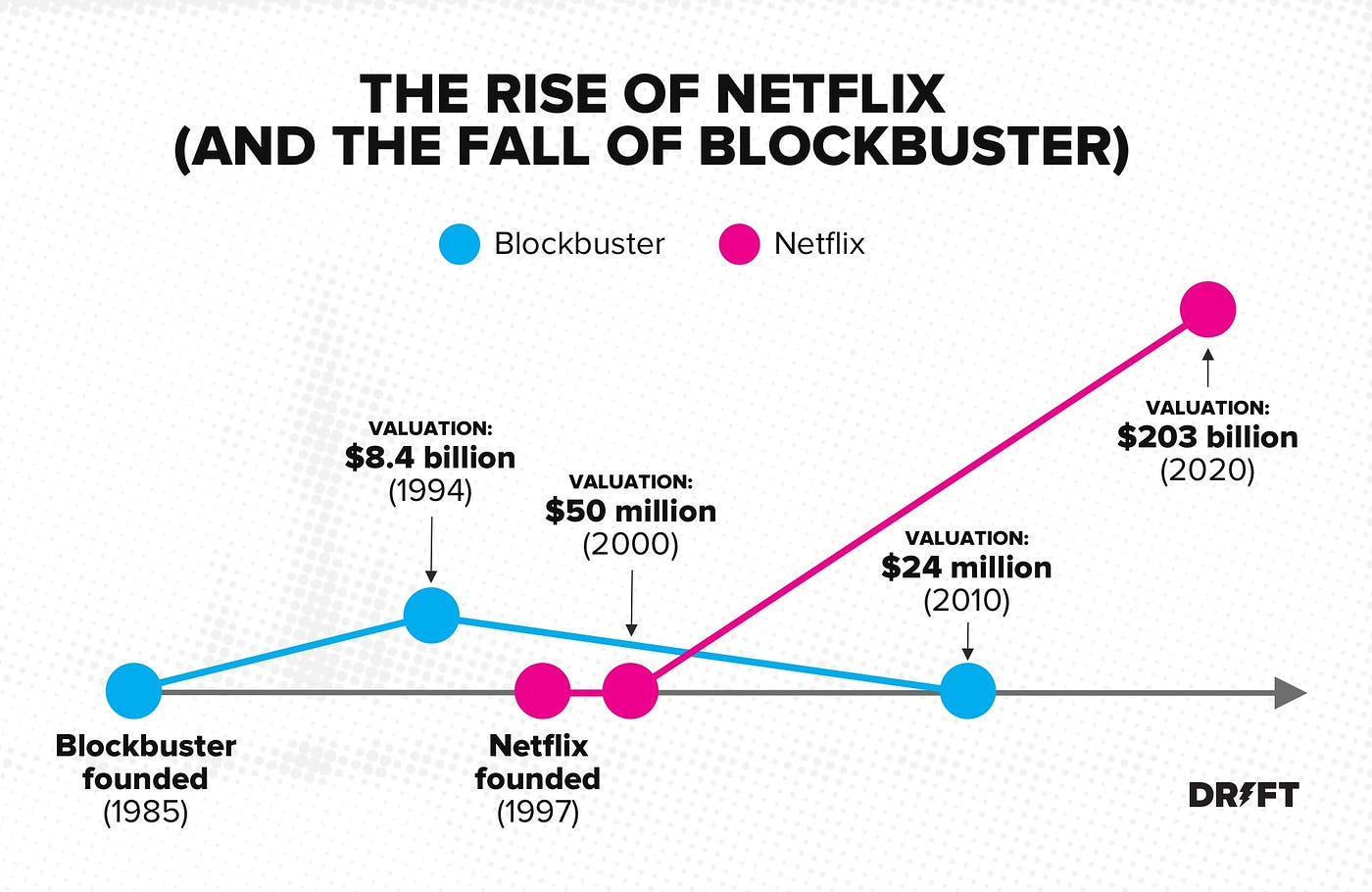

Think about Blockbuster.

While investors were still counting store locations and rental revenues, they missed the real warning signs:

Customers were increasingly frustrated with late fees

Netflix was gaining popularity, but Blockbuster dismissed it

Top talent was leaving for tech companies

The company was loading up on debt instead of investing in digital

Store traffic was declining, but they kept opening new locations

By the time these signs became obvious in the financial statements, it was too late.

The Death Spiral Formula: What Really Kills Businesses

When a business shows 4 or more of these signals, there's a high chance of serious trouble within 24 months. Let's break down each one:

1. Margin Decay

What it means is the company is making less money on each sale.

For example think about traditional retailers. When they start offering bigger and bigger discounts just to keep customers coming in, that's margin decay in action.

Warning signs:

Constant sales and promotions

"Special offers" becoming the norm

Rising costs without ability to raise prices

Heavy discounting to match competitors

A well-known example of margin decay can be seen with Sears - once a dominant force in the American retail industry.

They struggled with heavy discounting and constant promotions to compete with newer - more agile competitors like Walmart and Amazon.

2. Talent Exodus

Taken exodus is when smart people are jumping ship.

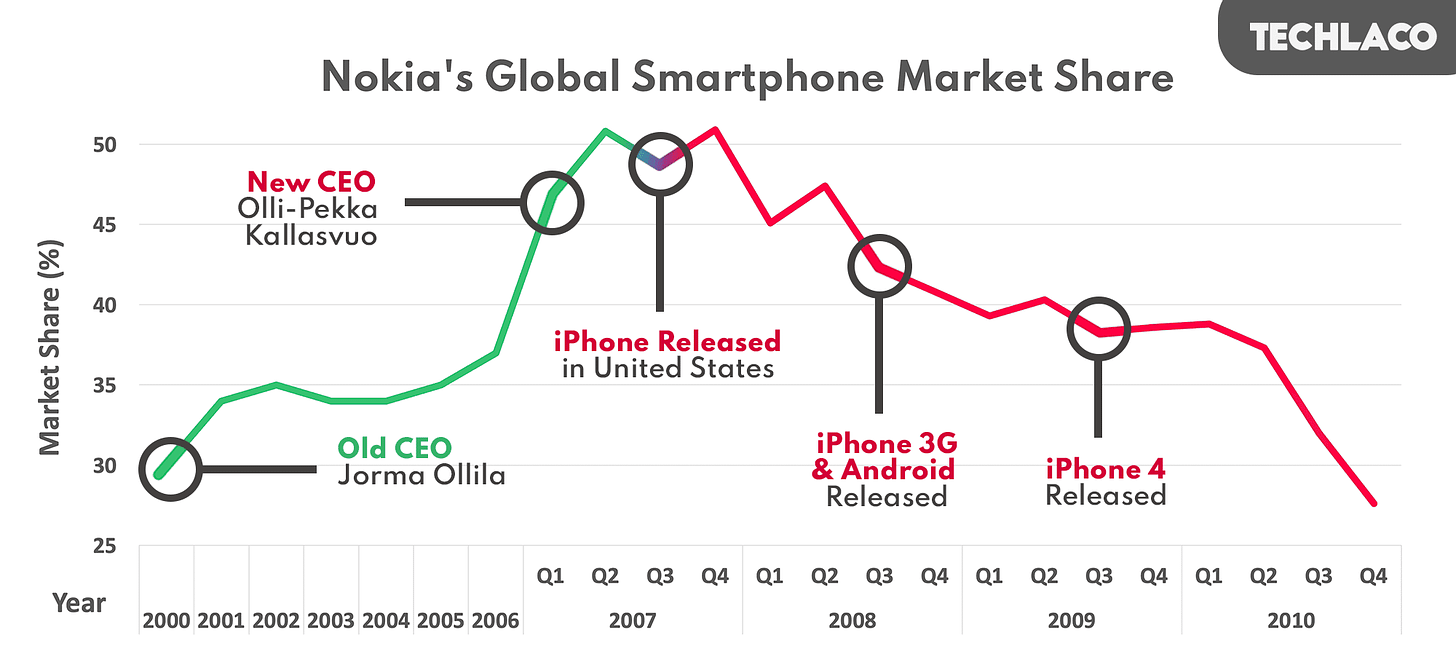

Before Nokia's mobile phone business collapsed, their best engineers and designers were leaving for Apple and Google. They - the people from the inside - knew something wasn't right.

Warning signs:

Senior executives leaving "to pursue other opportunities"

Negative employee reviews on Glassdoor

Increasing job postings for key positions

LinkedIn shows employees moving to competitors

3. Rising Debt

This is when the company needs to borrow more just to keep running.

Debt can be a great engine of growth - but when companies use it to run daily operating activities, trouble isn’t far.

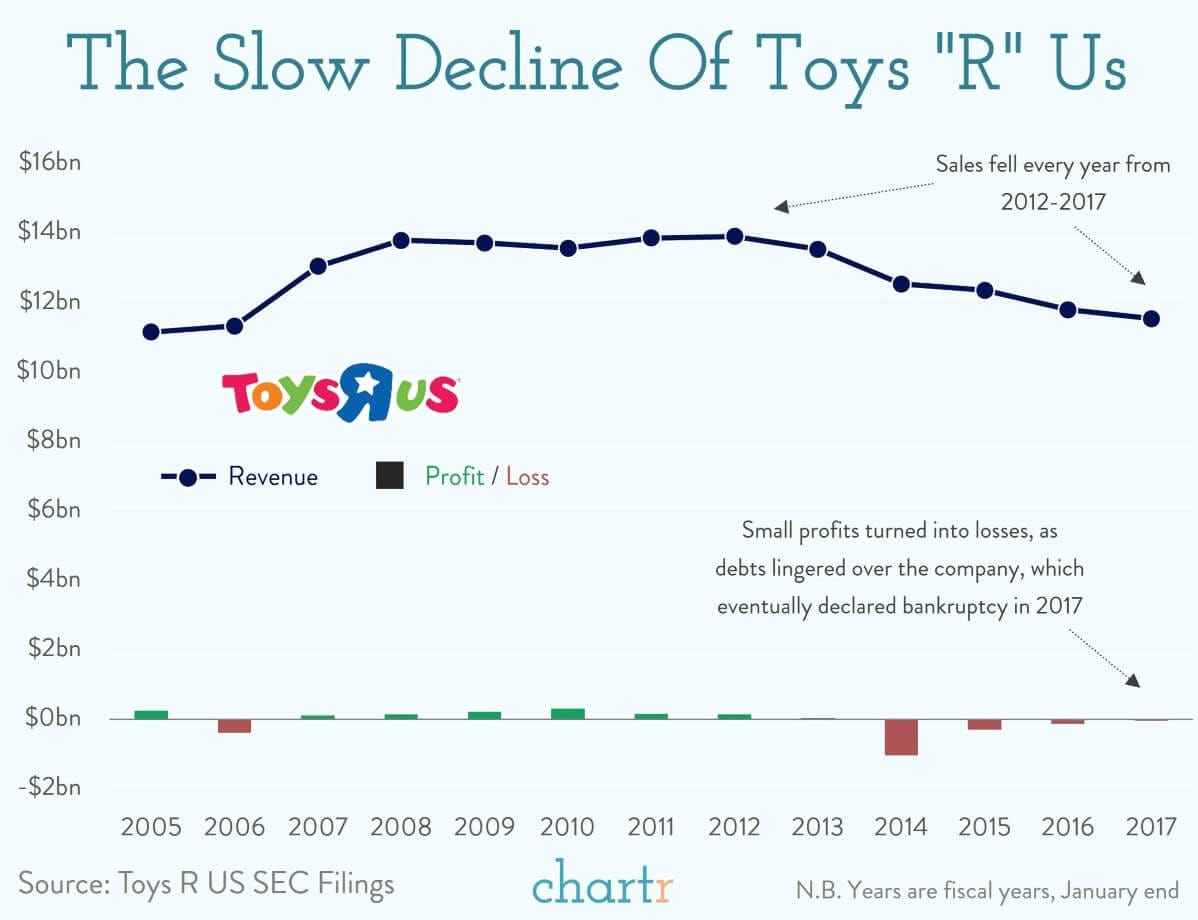

For example - before Toys "R" Us went bankrupt they were borrowing money to pay for daily operations, not for growth.

Warning signs:

Increasing debt without corresponding growth

New loans to pay off old ones

Credit rating downgrades

Rising interest expenses

4. Innovation Freeze

Sometimes it can happen that the company stops creating new things and starts copying competitors.

And when a company loses its identity - that’s usually not a good sign.

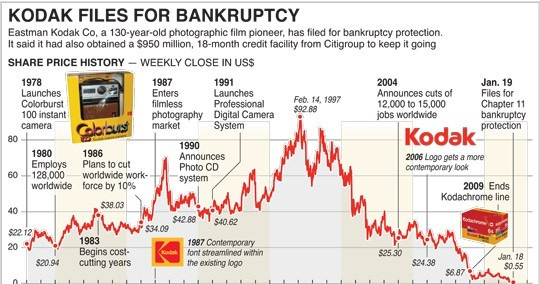

Take Kodak - they invented digital photography but refused to develop/ improve it because they were too focused on protecting their film business.

Warning signs:

Products looking identical to competitors

Falling R&D spending

Few new product launches

Playing catch-up instead of leading

5. Customer Flight

When customers are slowly but surely leaving you’re in for problems.

At the end of the day - your company and product is nothing without people buying it.

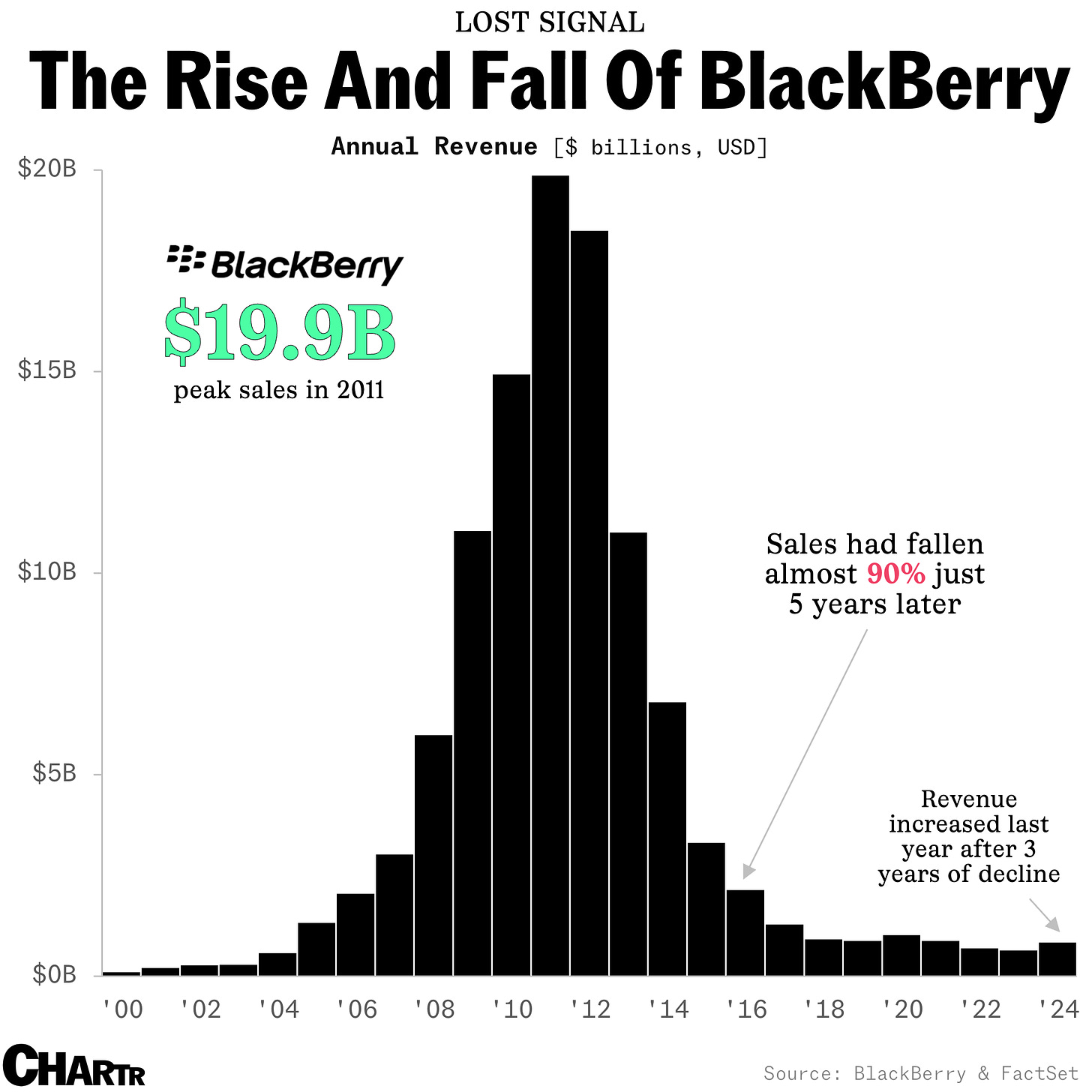

Before BlackBerry's collapse, users were switching to iPhones and Android phones one by one. The thing is it actually started slow - but became an avalanche soon enough.

Warning signs:

Declining repeat purchases

Falling customer satisfaction scores

Increasing customer complaints

Lower social media engagement

The Simple Way to Check Any Company's Health

You don't need fancy software or a finance degree. Just 15 minutes a month checking these areas:

1. Financial Health Check

Look for:

Revenue growth compared to last year

Profit margins trending up or down

Cash flow (is it positive or negative?)

Debt levels (are they growing?)

Use free tools like Yahoo Finance or Google Finance. Look at the "Financial Statements" section. If you see multiple (5-6) consecutive quarters of declining margins, that's a red flag.

2. Customer Happiness Check

Happy customer = Happy business

Look for:

App store ratings

Social media sentiment

Online reviews

Customer complaint patterns

Just Google "[Company Name] customer reviews" and read the most recent ones. Look for patterns, not individual complaints

3. Employee Satisfaction Check

Look for:

Glassdoor ratings and trends

LinkedIn employee movement

Indeed.com company reviews

Management turnover

On Glassdoor - don't just look at the rating. Read recent reviews and look for recurring themes.

The Three Deadly Patterns That Predict Failure

1. The Death Triangle

This pattern showed up in 90% of bankruptcies 12 months early:

Margins ⬇️ Debt ⬆️ Cash ⬇️

How it works:

Margins start falling

Company borrows money to compensate

Cash flow shrinks as debt payments increase

More borrowing needed

Spiral continues until bankruptcy

This exact pattern played out at Sears. They saw falling margins, borrowed more money, which led to higher interest payments, which ate into their cash flow, forcing them to borrow even more.

2. The Culture Collapse

When you see these signs together, trouble is brewing:

Key talent leaving: Leaders and top performers quit first

Glassdoor ratings drop: Especially when long-term employees post negative reviews

Innovation slowdown: Fewer new products, more "me too" offerings

Cost obsession: Cutting corners becomes the norm

Mission drift: The company loses sight of what made it successful

Before WeWork's implosion for example, they shifted from their original mission of "creating community" to just chasing growth at any cost.

The culture shifted from innovative to chaotic.

3. The Customer Exodus

Once this starts, recovery is rare:

Social mentions decline: Less organic buzz

Review scores fall: Especially from loyal customers

Customer service deteriorates: Budget cuts here are a huge red flag

Price sensitivity increases: Customers no longer see the value

Retention rates drop: Existing customers leave

Complaint volume rises: And the nature of complaints changes from minor issues to core problems

One last example - Remember MoviePass?

The warning signs were all there: customers complaining about service changes, rising prices, and basic functionality issues.

Key Lessons to Remember

Problems Compound:

Small issues become big ones

Warning signs usually multiply

Speed of decline accelerates

Culture Predicts Future:

Happy employees = happy customers

Innovation requires good culture

Leadership sets the tone

Customer Behavior Tells the Truth:

Watch what they do, not what they say

Declining loyalty is a huge red flag

Price sensitivity signals problems

Debt Is a Double-Edged Sword:

Good debt fuels growth

Bad debt masks problems

Debt problems compound quickly

Ready to take your investing journey to the next level?

Whenever you’re ready, here's how I can help:

"How to Grow Your Money Effortlessly with High-Performing ETFs": My comprehensive guide for busy professionals who want to build wealth without the stress of stock-picking.

Learn how to:

Create a high-performing ETF portfolio in less than a day

Select ETFs that provide safety and are future-ready

Automate your investments for truly hands-off wealth building

Plus, get exclusive access to:

Custom ETF Portfolio Tracker

An ETF Selection Checklist

Market Downturn Survival Guide

Private community of like-minded investors

and 11+ other bonus resources (including access to 16+ free investing ebooks).

Don't let another day pass watching your savings stagnate.

Join thousands of readers who are already on their path to financial freedom.

[Click here to get started today and save 70% with our special subscriber discount!]

Oh and here are some other newsletters I enjoy reading and recommend:

This newsletter is for informational purposes only and is not intended as financial advice. The insights provided are illustrative and should not be the sole basis for investment decisions. Readers should conduct their own research and consult professional advisors before investing. The authors and publishers are not liable for any financial losses resulting from actions taken based on this content. Investing in the stock market involves risk, including potential loss of capital.

Great article! I know some of these things are more qualitative, but it'd be nice to have a screener for those of these that can be quantified, at least as a starting point. It's hard to keep track of all of these across 20-30 open positions.