The 5 minute beginner guide to Stocks every young professional should read

WeLearn Wednesday: Learn a new money concept every week

Everyone has heard of “stocks” or a “share” before. We know it’s this thing which means you somehow own part of a company. And this thing can make you win money or lose some.

And Yes, that’s essentially what it is.

But I’ve noticed that many people still do not get the implications of stocks and are not comfortable enough with the topic to get started.

One common misconception is people tend to think investing in stocks does not work with their current situation - that it does not apply to them.

So today I want to fix this by giving you everything you need for your next steps as a starting investor. And show you why it is something for you.

As legendary basketball coach John Wooden once said:

"Get the fundamentals down and the level of everything you do will rise.”

So in today’s issue you will learn:

What is a stock and why invest in them

Risks and rewards. Is it suited for me?

How can I get started?

Common misconceptions

What should my next steps be?

So what’s a stock and why should I invest in them?

A stock is like a slice of a company's cake, representing a piece of its total value.

Think of Apple. If it releases 100 shares and you buy one, you own 1% of Apple.

Owning a stock means holding a slice of the company's assets and earnings.

Assets are things a company owns. For Apple, this could be money in the bank, their stores, and the iPhones they haven't sold yet

Earnings is money a company makes.

See below the Stock Ownership of Apple:

🔹For those wandering: a Stock and Share are pretty much the same thing - a stock represents ownership in a company as a whole, while a share refers to a specific unit of that ownership.

There are different types of stocks: Common stocks and Preferred Stocks.

Common stocks are like buying a piece of a company, getting a share of its profits, and a vote in its big decisions.

Preferred stocks are like a special membership; you get payouts first and have a higher claim if things go south, but you might not get a vote in decisions.

Neither is strictly "better" – it depends on your goals. Most of the time you’ll deal with Common stocks - they are more popular.

But why invest in stocks?

If you had put $1,000 in a savings account in 2013 with an average annual interest rate, such as 1%, your money would have grown to about $1,104 by today.

But let’s say instead you had invested $1,000 in Walmart's stock in 2013 at $73 per share.

If you held onto it until today when it's worth $160 per share, your $1,000 would have grown to about $2,192. That’s $1,088 more than the savings account.

I used the example of Walmart because I want to show you that you do not have to be super smart and find the next “Apple” to make money.

Regular good companies that you see and use daily and aren’t that special can also make money for you. People often forget this.

Investing has three main benefits:

Money Growth: Like planting a seed and watching it grow, your money can increase in value over time.

Passive Income: Like getting a bonus or gift without working extra hours, as some investments pay regular dividends.

Dividends are regular payments that a company makes to its shareholders as a share of its profits

Future Security: Think of it as building a safety net or savings jar for big future plans or unexpected needs.

Risks and Rewards: Is it really for me?

What you need to know:

The Ups and Downs

Stocks can be a rollercoaster ride. They're influenced by all sorts of things – good news, bad news, and everything in between.

Volatility: This term simply means that stock prices can go up and down quite a bit. Think of it like a bumpy road. Sometimes, it's smooth, and sometimes, it's a bit rocky.

Why It Matters: When bad news hits a company (like a company scandal), people might rush to sell its stock. That can make the price drop. It's called "negative sentiment." But remember, the same volatility can create opportunities to buy low.

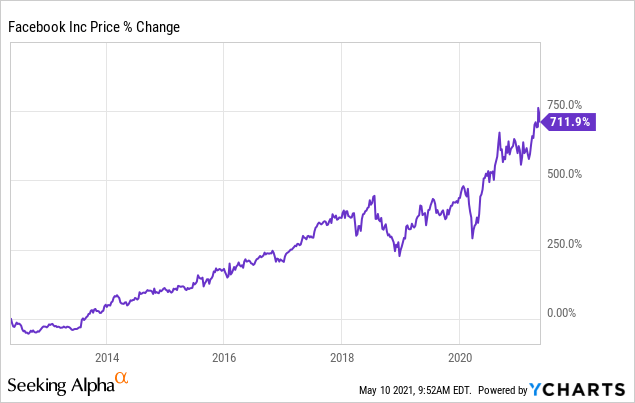

🔹Facebook is a good example of a company that experienced strong volatility but still made its investors a lot of money. See below:

Historical Performance: What's in it for You?

Over time, stocks have often been like the growth engine of investments. Here's why:

Higher Returns: Historically, stocks have given better returns than many other investments.

Patience is Key: But here's the catch - you need to be patient. Stocks can have their rough days, but over the long run, they've rewarded people generously. Past performance can be impressive, but it's not a crystal ball for the future.

Here’s a quick comparison of how stocks on average did compared to bonds since Covid:

🔹The balanced fun is a mix of stocks and bonds. These exist to try and limit the risk of stocks but still benefit from the money returns stocks generate.

So is it a Fit for You?

Stocks can be your thing if:

You have financial goals on the horizon.

You're cool with your investments taking some ups and downs. (Don't worry, there are ways to smooth the ride)

You can stash away some money for at least 3 years. This is not a deal breaker but I really think investing is a long term thing.

You're curious and ready to learn about stocks. By far the most important criteria.

You can start small and grow over time.

If you’re still feeling uncertain about stocks, that’s okay.

Investing isn't just about owning individual stocks. We'll explore other options in the next issues.

Basics of How to Start

Laying the Groundwork: The Emergency Fund

Before diving into stocks, do consider establishing an emergency fund if you don’t already have one.I can't stress enough the importance of it.

It's a savings cushion for unexpected expenses—like medical emergencies or job losses. It ensures you don’t need to pull out investments in a pinch, potentially at a loss.

Find the right brokerage account: Think of these as the gateways to the stock world: they let you buy and sell stocks.

There are several reliable platforms out there. They provide tools tailored for both beginners and seasoned investors alike.

You’re basically setting up a new bank account but for your stocks.

I’m based in the EU and I think Etoro, Interactive Brokers and Degiro are the best places to start. But here are good links for you to check out what’s best for you.

🔗

Understand Market Research: This is your compass in the stock terrain.

Start with the essentials: keep up with financial news, familiarise yourself with stock market apps, and get to know basic terms.

By following this newsletter you’ll get to learn plenty more on this.

Investment Strategies: It's not just about throwing money around - it's about having a game plan.

Some people lean towards value investing, searching for stocks that are undervalued.

Others opt for growth investing, hunting for stocks with high growth potential.

And then there are those who prefer the steady beat of dividend investing, earning from regular payouts.

Decide what’s best for you.

Diversification: Ever heard the saying, "Don't put all your eggs in one basket"?

That's diversification in a nutshell. Spread out your investments.

It’s a safety net, ensuring that if one sector dips, another might cover for it.

Starting Small: No, you don't need to break the bank.

Today's platforms have made it easier than ever.

Fancy a piece of Microsoft but don't have the sum (one share costs around $315)?

Go for fractional shares. It's like a slice of the slice of the pie, but it's a start.

Common Misconceptions

Timing the Market: One of the biggest myths is that you can precisely time the stock market. But as investing legend Warren Buffett suggests, it's not about timing the market; it's about time in the market. —> Patience beats Luck.

🔗Check out this site to simulate how much investing could bring you in the long term. You’ll see, the longer the time frame, the greater the money returns.

Quick Riches: Those stories of overnight millionaires? They're the exception, not the rule.

Think of the stock market as a marathon, not a sprint.

Long-term investments, with patience, yield the best results.

"Hot Tips": Generally speaking just don’t take advice from most people including family and friends.

Unless they really know what they’re talking about

Investing based on hearsay can be like navigating without a map.

More Stocks Equal More Success: Some believe that having a portfolio with multiple stocks guarantees success.

In reality, managing too many stocks can reduce focus and prevent proper tracking.

It’s quality, not quantity.

Takeaway: Summary and Next Steps

Problem: Many are hesitant or unsure about entering the stock market due to misconceptions and lack of understanding.

Solution: Equip yourself with knowledge through reputable sources, set clear investment strategies, and stay updated on market trends.

Quick to-do list based on today

Read & Educate: This newsletter + books + podcast is a killer combo.

Choose a Brokerage: Check out the links I shared to figure out what is best for you.

Stay Updated: Bookmark sites like Bloomberg or Reuters for daily financial news.

Invest with Purpose: Know your goals, get to know different strategies and find out what works for you.

Thank you for reading this issue. I hope you learnt something.

If you want to read more and receive weekly money tips, subscribe!

It’s 100% free. See you inside.