The 3-Letter Path to Profits: Mastering ROI

#25 Boost your Investing Game in 5mins every Saturday

What’s one of the metric that makes or breaks successful businesses?

I'm talking about ROI - three powerful letters that are the ultimate scoreboard for a company's profitability.

In today’s issue, we’ll go behind-the-scenes on this make-or-break number.

What is ROI for Companies?

ROI (Return on Investment) measures how much profit a company generates from its investments and capital expenditures.

It shows the bang they get for their buck on things like:

New equipment or machinery purchases

Research and development projects

Marketing campaigns

New product launches

Facility expansions

Technology upgrades

Essentially, ROI reveals whether these investments are actually paying off and contributing to the bottom line.

As an investor, you can get a sense of a company's ROI by analyzing metrics like return on equity (ROE), return on assets (ROA), and return on invested capital (ROIC) in their financial statements and reports.

These ROI-related figures provide a window into management's capital allocation skills and overall profitability.

You can also review a company's investor presentations and transcripts, where management often discusses expected ROIs for major investments like acquisitions, capital expenditures, and strategic initiatives.

These give you key insights into the potential value creation.

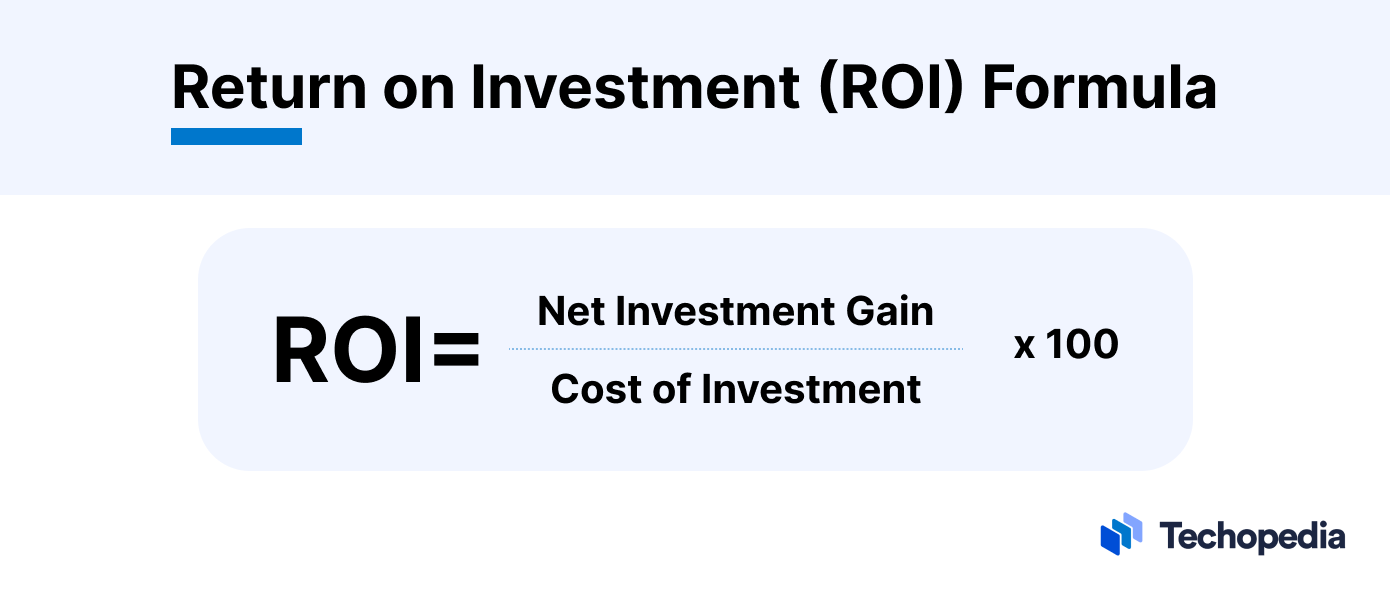

How Companies Calculate ROI

The formula is:

ROI = (Gain from Investment - Cost of Investment) / Cost of Investment

For example, if a company spent $1 million on new factory equipment that increases revenue by $300,000 per year, the ROI would be:

ROI = ($300,000 - $1,000,000) / $1,000,000 = -70% for first year

Mmm, that’s a negative ROI the first year due to that huge upfront cost.

But cumulative ROI (year-over-year) is what matters.

Why ROI is Crucial

A positive, strong ROI allows companies to grow efficiently by reinvesting those returns on more profitable projects and initiatives.

It's the number executives obsess over because it indicates:

Whether an investment made financial sense

If the company is spending money wisely

Potential for future revenue and profit growth

For public companies, generating consistently high ROIs keeps investors and shareholders happy.

Here are some Real-World ROI Examples for you:

Coca-Cola reinvested profits to build their billion-dollar brand, factories, and distribution network over decades, generating ~16% ROI annually

Amazon originally operated at a negative ROI, prioritizing growth. But its cloud computing arm AWS now generates ~30% ROI

Manufacturing companies often require 15%+ ROI to pursue equipment upgrades

Pharmaceutical companies need 25%+ ROI to cover high R&D costs of developing new drugs

ROI Benchmarks: Different industries have different ROI benchmarks:

15%+ = good for manufacturing, transportation

20%+ = good for consumer goods, retail

25%+ = good for technology, energy

Anything <10% is typically undesirable

The Power of Compounding ROI

The REAL magic happens when companies can sustain high ROIs over long periods.

A 20% ROI compounds every year, turning $1 invested into $6.72 after 20 years. $10 million becomes $67.2 million!

This compounding ROI is how companies like Coca-Cola, Nike, and Apple built BILLIONS from their marketing, products, and strategic investments over decades.

So what are some actions (and positive signs for investors) companies can do to Increase ROI?

Here are some of the main ones:

Invest in innovations or efficiency upgrades that reduce costs over time

Enhance value perceptions to justify price increases and boost revenue

Focus marketing on highest-ROI customer segments

Cut unnecessary expenses that don't generate returns

Optimize systems and workflows to get more output from current investments

Exit low or negative ROI initiatives quickly to preserve capital

Case Study: Schlumberger

As one of the world's largest oilfield services companies, Schlumberger is a master at maximising ROI across its operations:

-Exploration ROI: Schlumberger's seismic surveys, sampling and reservoir mapping help oil companies greenlight only the highest ROI drilling projects.

-Manufacturing ROI: Advanced robotics, AI and lean production allow Schlumberger to build drilling equipment at industry-leading margins.

-Technology ROI: Patented innovations like directional drilling and digital downhole tools boost customer ROI by up to 20%.

-R&D ROI: Every new product gets rigorously analysed for ROI impact. Their fracking tech now generates estimated 50%+ ROIs.

M&A ROI: Stringent ROI modelling on synergies, efficiencies and growth guides Schlumberger's merger & acquisition strategy.

This relentless ROI focus has enabled Schlumberger to achieve median ROIs of 14-18% for decades - elite returns in the volatile energy sector.

That's ROI supremacy powering consistent profitability.

And there you have it - the ultimate insider guide to ROI from a business perspective.

Understanding ROI gives you a huge competitive advantage, whether you're an entrepreneur evaluating a new product, a manager proposing an initiative, or even a stock investor sizing up company profitability.

Your time to shine now :)

Thanks for reading.

Eager to dive deeper into the world of financial growth?

Subscribe to this newsletter for a regular dose of financial wisdom & actionable investing tips to complement your busy life.

It’s free and just a click away.

See you on the other side.

Here are some other newsletters I enjoy reading and recommend (and that I get a ton of value from):

This newsletter is for informational purposes only and is not intended as financial advice. The insights provided are illustrative and should not be the sole basis for investment decisions. Readers should conduct their own research and consult professional advisors before investing. The authors and publishers are not liable for any financial losses resulting from actions taken based on this content. Investing in the stock market involves risk, including potential loss of capital.