I asked the best AI models to predict the next 365 days of markets. Here's what it found.

What AI models say about the next market cycle

Last week, I decided to try something different.

Instead of reading another analyst report or listening to another CNBC debate, I asked a more fundamental question:

"What is the data actually telling us about the next 12 months in global markets?"

So I did what most investors don't:

I gathered institutional-grade research from Goldman Sachs, BlackRock, Morgan Stanley, the IMF, and 18+ elite sources. Reports that cost thousands. Data that hedge funds base strategies on.

Then I fed it all into an advanced AI model.

What came back?

A very different market outlook than what you’re hearing on financial TV.

And if the AI is right, the strategies that worked for the last 15 years are about to break.

1️⃣ What I fed into the machine

This wasn’t surface-level research.

I included:

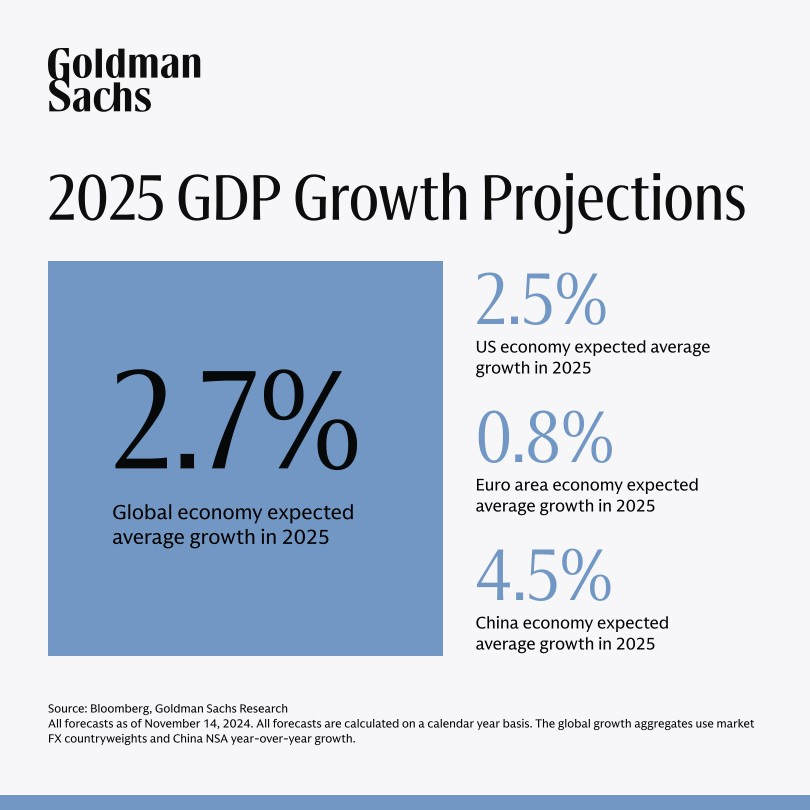

Goldman Sachs’ 2025 global outlook

BlackRock’s institutional models

Morgan Stanley’s cross-asset strategy reports

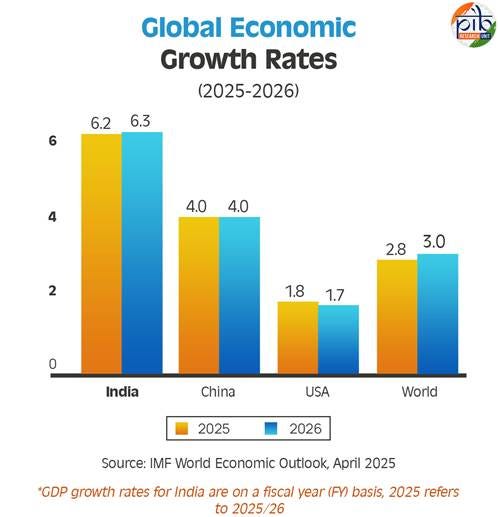

IMF macroeconomic projections

And I added:

Real-time hedge fund positioning

Currency flow data from central banks

Earnings revisions from 3,000+ global companies

50 years of historical technical analysis

Over 500 pages of raw market intelligence.

The AI synthesized it into one conclusion:

"A multi-year leadership rotation has already begun.

And many investors are not ready for it."

2️⃣ The bubble that is tough to admit

Here’s what the data shows:

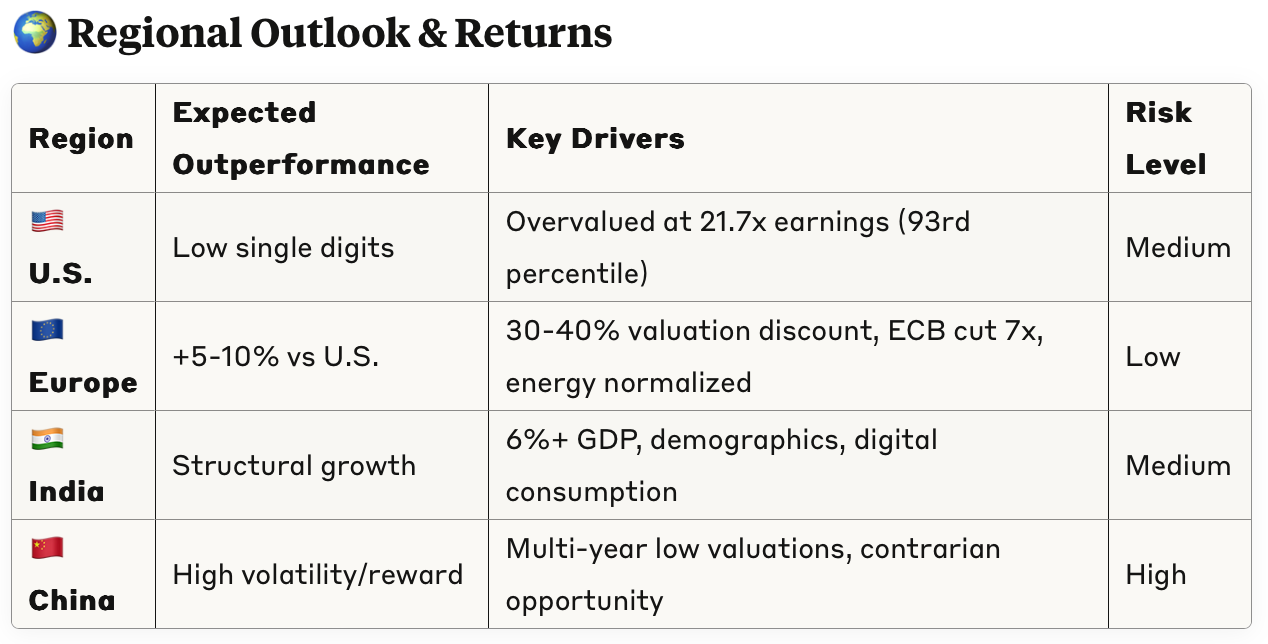

U.S. stocks trade at 21.7x forward earnings. That’s the 93rd percentile historically.

European stocks trade at 13–15x. A 30–40% discount.

The valuation gap is wider than it’s been since 1979.

What happened after 1979?

International stocks crushed U.S. stocks for a decade.

This time, it’s setting up again.

Only now, the AI mapped out how it happens.

3️⃣ The three dominoes about to fall

● Domino #1: The Fed Trapped Itself

Inflation is stuck around 3%.

Too high to cut, too low to hike.

Meanwhile, the economy is slowing.

The AI found that in similar historical setups, the Fed always waits too long.

And then overreacts.

Prediction: March 2026. Powell caves and starts cutting hard.

This doesn’t just boost U.S. stocks.

It floods the world with liquidity.

And when that happens, cheap international assets rally hardest.

● Domino #2: China’s $1.5 trillion stimulus bomb

China is growing at 4.8%.

Which sounds fine.

Unless you're China.

Because historically, when growth drops below 4.5%, Beijing hits the panic button.

If Q3 data misses, expect:

Infrastructure blitz

Subsidies

Bailouts

AI estimate: $1.5 trillion in stimulus. Minimum.

That means:

Commodities go vertical

Emerging markets rally

European exporters soar

But U.S. tech, especially trade war targets?

Not so lucky.

● Domino #3: Big pharma’s shopping spree

Big Pharma is sitting on $1.5 trillion in cash.

Biotech is down 70% from its highs.

And the real game changer here?

Patent cliffs are coming. Billions in revenue disappearing.

The setup: desperate buyers + undervalued sellers = M&A boom.

The AI flagged this as the most asymmetric trade of 2025–2026.

"The first wave of deals could re-rate the entire biotech sector by 300–500%."

4️⃣ The rotation

The AI didn’t stop at catalysts.

It ranked regions and sectors most likely to lead next.

🇩🇪 Europe: The comeback nobody expected

ECB has already cut 7 times

Energy prices normalized

Fiscal stimulus is coming

Yet valuations are still at multi-decade discounts.

AI prediction: Europe outperforms U.S. by 5–10% over the next year.

🇮🇳 India: the demographic goldmine

6%+ GDP growth

Huge working-age population

Rising digital consumption

From IT services to local banks, the AI flagged this as the clearest structural growth story in global markets.

🇨🇳 China: The contrarian bet

Everyone’s avoiding it.

That’s why the AI says watch it closely.

Valuations at multi-year lows

Global investors already capitulated

Any small improvement in trade, GDP, or sentiment could unleash explosive upside.

High-risk? Yes.

High-reward? Also yes.

5️⃣ The sectors that will have an impact

#1: Tech (but not the usual names)

Mega-cap U.S. tech trading at 30x+? Vulnerable.

AI infrastructure, semis, and overseas tech? Still undervalued.

European and Asian tech = same growth, half the price.

#2: Healthcare & Biotech

Clinical-stage biotech trading below cash

Big Pharma on the hunt

AI accelerating drug discovery

"Pfizer buying a $10B company for $50B is not out of the question."

#3: Communications & Media

Written off due to streaming drama

But ad spend is rebounding

Profitability models are stabilizing

Many names now trade at single-digit P/Es.

The losers?

Energy (range-bound)

Financials (credit risk)

Utilities (rate sensitivity)

Real estate (CRE stress)

"Avoid the bottom entirely. Focus capital on the top tier."

6️⃣ The portfolio that actually makes sense

AI model allocation recommendation:

35% U.S.: Focus on small-cap value, not overpriced mega-caps

25% Europe: Banks, industrials, clean energy

15% Emerging Asia: India overweight, China selective

10% Other DM: Japan for quality + stability

15% Defensive: Gold, cash, quality bonds

Key insight: You don’t abandon the U.S. You rebalance exposure.

7️⃣ The biotech bet opportunity

This was the AI’s highest-conviction call:

"A biotech acquisition wave will reprice the entire sector."

Down 70%

Trading below cash

Ripe for takeovers

Target criteria:

Market cap $2B–$15B

Strong balance sheet

Large addressable market

Underpriced pipeline

Timeline: 6–18 months

Position sizing: Max 5–10%

Risk: High. But upside? 3x–5x.

8️⃣ The Risks That Could Derail It All

The AI didn’t just map the upside.

It stress-tested the entire outlook.

And calculated the scenarios that could flip this rotation on its head.

Let’s walk through them:

🟩 The Base Case — 60% probability

This is the AI’s core expectation.

A gradual and orderly shift: from U.S. overexposure to undervalued international markets.

No flash crashes. No bubble bursts. J

ust a quiet rebalancing of capital.

U.S. delivers low single-digit returns

Europe and EMs outperform by 5–10%

Value gaps close over 12–18 months

It's not dramatic.

But it rewards early positioning and punishes inertia.

🟥 The Bear Case - 25% probability

This is where things get harder.

If U.S.-China relations deteriorate further - we’re talking 60%+ tariffs or China choking off rare earth exports - the AI sees global recession risks rising sharply.

Markets would drop across the board.

But here's the key:

“International markets recover faster — because they're starting cheaper.”

When you're already priced for pessimism, you don't have as far to fall.

⚫ The Black Swans - 10% probability

These are the events no one predicts.

But everyone fears.

A Taiwan flashpoint that paralyzes global semiconductor supply

A coordinated cyberattack that freezes financial networks

A quantum computing leap that renders today’s encryption obsolete overnight

In each case, markets would tumble.

The flight would be into cash, gold, and ultra-safe bonds.

But even here, the AI’s message was steady:

“Diversified portfolios survive. Panic portfolios don’t.”

🟨 The Bull Case - 5% probability

Everything goes right.

Trade talks break through.

Central banks coordinate.

China and the U.S. pull back from confrontation.

Global growth gets a second wind.

If that happens?

International markets benefit most, because they're priced for nothing, and finally get something.

It’s the least likely outcome.

But if it hits, those already positioned will see explosive upside.

The AI’s Final Word on Risk:

“Position for the base case. Hedge for the bear. Stay flexible for the rest.”

That’s not just smart investing.

That’s how you stay in the game long enough to win it.

This newsletter is for informational purposes only and is not intended as financial advice. The insights provided are illustrative and should not be the sole basis for investment decisions. Readers should conduct their own research and consult professional advisors before investing. The authors and publishers are not liable for any financial losses resulting from actions taken based on this content. Investing in the stock market involves risk, including potential loss of capital.

interesting post!

Quite frankly in Europe I don't see this undervaluetion:banks ath,defense bubble,quality expensive.And of Usa drop,they drop as well(see April).