GOOGL - Why I'm buying more Google stock while others panic

Stock spotlight for your future-ready long term portfolio

"Google is becoming the next eBay... its energy is getting zapped out."

That's what famous tech investor Gene Munster said recently about Google.

He thinks Google is about to become old news, replaced by ChatGPT and other AI chatbots.

Is he right? Is the company behind the website most of us use every day really in trouble?

I don't think so.

In fact, I'm doing the opposite of what Gene suggests - I'm actually buying more Google stock right now. Let me explain why in simple terms.

The Numbers Tell a Different Story

Let's look at what Google (technically its parent company Alphabet) actually reported in their latest financial results:

Overall revenue grew 12% compared to last year, reaching $90.2 billion

Profits jumped an impressive 46% to $34.5 billion

Ad revenue (Google's bread and butter) increased 8.5% to $66.9 billion

The company is trading at 18 times next year's expected earnings (that's cheaper than the average S&P 500 company)

Wall Street clearly liked what they saw - the stock jumped about 5% immediately after these results came out.

That's because Google beat expectations across most areas.

The way I see it these are not the numbers of a company being "zapped" of energy.

They're signs of a business that's speeding up, not slowing down.

What About the ChatGPT Threat?

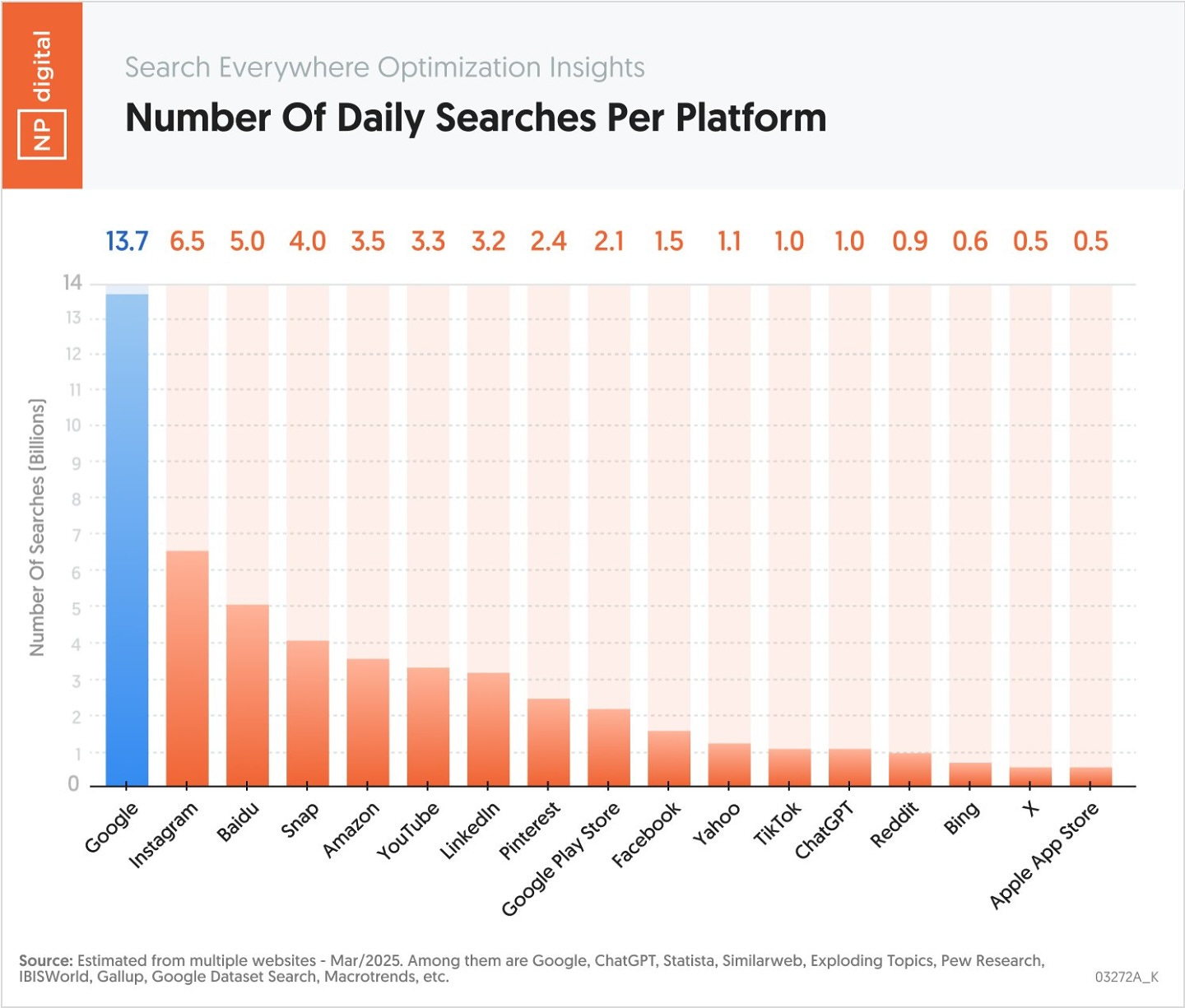

The big worry is that AI chatbots like ChatGPT will replace Google Search.

After all: why search for information when you can just ask a smart AI?

But here's what the actual user data shows:

Google Search is seeing "robust double-digit growth" in both revenue and usage

Over 2 billion people still use Google Search every day

Google's own AI search feature (called AI Overviews) already has 1.5 billion monthly users

Sundar Pichai, Google's CEO, highlighted this AI success in his statement:

"This quarter was super exciting as we rolled out Gemini 2.5, our most intelligent AI model, which is achieving breakthroughs in performance and is an extraordinary foundation for our future innovation. Search saw continued strong growth, boosted by the engagement we're seeing with features like AI Overviews."

If ChatGPT is stealing Google's lunch it sure isn't showing up in these numbers.

Google's different approach to AI

Google isn't building a single AI app to compete with ChatGPT.

Instead, they're adding AI to everything they make.

Their latest AI model (Gemini 2.5) is getting much better at reasoning, coding, and math. And instead of making people go to a separate website to use it, they've added it to 15 different Google products that each have more than 500 million users.

Pichai described this as their "unique full stack approach to AI" in the earnings call. He also specifically mentioned that Gemini 2.5 is "achieving breakthroughs in performance and is an extraordinary foundation for our future innovation."

I kind of see it a bit like the difference between building one super-restaurant versus adding great food to every restaurant in town. Google is doing the latter.

Beyond search: Google's other growth engines

Truth is: even if you're worried about Search, Google has several other massive businesses growing quickly.

It's important to note that if you compare Q1 2025 to Q4 2024, you'd see ad revenue down 7.7% and overall revenue down 6.5%.

But this is normal seasonality - Q4 is always Google's strongest quarter due to holiday advertising. That's why year-over-year comparisons (same quarter, different years) are more meaningful than sequential quarters.

Google Cloud

Revenue up 28% to $12.3 billion

Profit margins improving to 17.8%

So much demand they're spending $75 billion this year on new data centers

YouTube

Ad revenue up 10% to $8.9 billion

Together with Google One, they've surpassed 270 million paid subscriptions

#1 platform for streaming video watch time in the US

Waymo (Self-driving cars)

Now giving 250,000 paid rides per week

That's 5 times more than last year

Finally turning a sci-fi concept into a real business

As one analyst put it:

"If you didn't know ChatGPT existed, you would have NO WAY of knowing there's any competitive threat from Google's numbers."

Why some investors get this wrong

So why do smart people like Gene Munster get this wrong?

It's simple - predicting disruption is more exciting than pointing out boring success. It gets more attention, more clicks, and makes you sound smarter at dinner parties.

But successful investing isn't about excitement. It's about finding solid businesses with good growth and reasonable prices.

That's exactly what Google is right now - a cash-generating machine with multiple growing businesses, smart AI integration across its products, and a stock price that's actually cheaper than the market average despite growing faster.

My Investment Approach

It’s true that many investors worry about short-term issues like tariffs and recession risks. I'm focusing on high-quality companies trading at reasonable prices.

Google checks all these boxes.

The stock market often gets caught up in dramatic stories about winners and losers. But business reality is usually much slower and more predictable than these stories suggest.

I'll keep buying Google while others panic about the "next eBay" narrative. Sometimes the boring investment choice is the right one.

Oh and here are some other newsletters I enjoy reading and recommend:

This newsletter is for informational purposes only and is not intended as financial advice. The insights provided are illustrative and should not be the sole basis for investment decisions. Readers should conduct their own research and consult professional advisors before investing. The authors and publishers are not liable for any financial losses resulting from actions taken based on this content. Investing in the stock market involves risk, including potential loss of capital.