Everyone thinks ChatGPT killed Google search - here's why they're wrong (and missing big returns)

Investment analysis - Google

The world's most profitable AI company is trading at the wrong price.

It’s time to pay attention.

Here's what everyone got wrong about Google.

The market obsessed over AI disruption fears, butthey missed the most obvious fact:

Google isn't being disrupted by AI.

Google IS artificial intelligence.

And the numbers prove it.

1️⃣ The central thesis: Google owns the AI game (and always has)

This isn't wishful thinking from a Google fanboy.

It's what the data actually shows:

$264 billion in annual search advertising revenue (2024)

90% market share in global web search

14 billion daily search queries processed

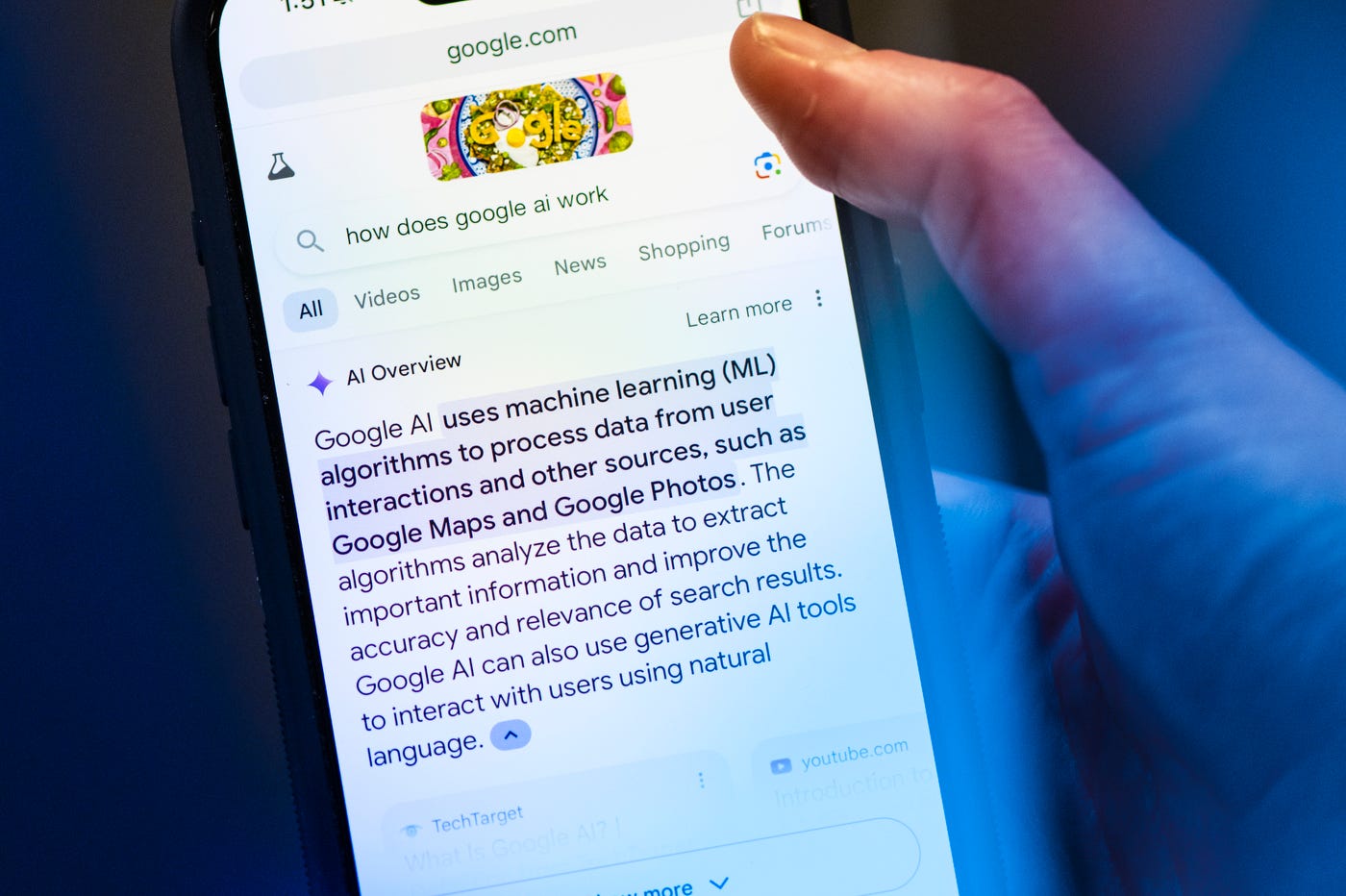

Gemini AI integrated across every product

While investors panicked about ChatGPT, Google quietly built the most advanced AI infrastructure on the planet.

"AI will be vastly more transformative than the internet or mobile phone," said co-founder Sergey Brin this week.

The man who helped create Google search just told you AI is bigger than the internet.

2️⃣ What's different now? Google stopped playing defence

For two years, Google looked asleep at the wheel.

ChatGPT launched. OpenAI got the headlines. Google's stock lagged.

But that narrative just died.

This week, CEO Sundar Pichai announced what he called a "total reimagining of search" - AI Mode.

Not a side project. Not an experiment.

A complete overhaul of the product that generates nearly all of Google's profits.

The message is clear: Google isn't afraid of AI disruption.

3️⃣ The numbers that matter to your portfolio

Here's the financial reality some investors are missing:

Revenue diversity:

Search ads: $264B annually

YouTube: $36B annually

Cloud: $43B annually

Other bets: Growing fast

Market position:

90% of web searches

75% of mobile phones (Android)

Chrome browser: Most popular globally

Gmail, Maps, Calendar: Ubiquitous

AI advantage:

20+ years of search data

Billions of daily user interactions

Massive compute infrastructure

DeepMind (Nobel Prize-winning AI research)

This isn't a tech company pivoting to AI.

This is becoming THE AI company that happens to dominate search.

4️⃣ Why the "Google disruption" narrative was wrong

Remember the panic?

"ChatGPT will kill Google search!" "Why would anyone use Google when they can chat with AI?" "Search is dead!"

Here's what actually happened:

Google search volume: Still growing

Market share: Still 90%+

Ad revenue: Still climbing

User engagement: Increasing with AI features

The disruption story was backwards.

AI didn't replace search. AI made search infinitely more valuable.

Now Google can give you conversational answers, personalized results, and targeted ads that actually help.

It’s not disruption.

I think of it as evolution with a moat.

5️⃣ The valuation opportunity hiding in plain sight

AI hype stocks tend to get most of the attention.

Google got left behind.

Yet the numbers are incredible:

P/E ratio: 18x (significantly below 5-year historical average)

PEG ratio: Under 0.95 (growth at a reasonable price)

Free cash flow margin: 21% (massive cash generation)

Stock performance YTD: Down 11% while many peers rose

Compare that to:

Microsoft: 34x P/E

Meta: 24x P/E

Google is the cheapest Big Tech stock trading today.

And it's the one with one of the strongest AI position.

6️⃣ The revenue model that prints money

Here's the beautiful thing about Google's AI transformation:

Every improvement makes ads more valuable.

Traditional search: Show 10 blue links, hope someone clicks

AI search: Understand context, provide perfect answers, show hyper-targeted ads

"AI mode is giving you context, expanding your interest, your curiosity," says CEO Pichai. "Those are much higher quality referrals for advertisers."

Translation: Higher ad prices. Better conversion rates. More revenue per search.

The AI revolution doesn't hurt Google's business model.

It supercharges it.

7️⃣ The subscription goldmine just getting started

Google isn't just betting on ads anymore.

New revenue streams are exploding:

AI subscriptions:

Basic tier: $20/month

Ultra tier: $250/month

Higher margins than OpenAI or Anthropic

Advanced features:

Project Mariner (AI agent): Completes tasks automatically

Project Astra (multimodal AI): Sees and responds to real world

AR glasses integration: The future of computing

These are new profit centres for Google with premium pricing.

8️⃣ The competition reality check

Let's be honest about the "threats":

OpenAI/ChatGPT:

Great product, zero profits

Burning cash on compute costs

No distribution advantage

Needs Microsoft's infrastructure

Perplexity:

30 million users vs Google's billions

CEO admits Google's reach is "difficult to disrupt"

Tiny compared to Google's scale

Microsoft/Bing:

Spent billions on AI integration

Still has under 10% search market share

Google's lead actually increased

The competition is real yes.

But Google's advantages are structural and massive.

9️⃣ The data moat that can't be replicated

Here's Google's secret weapon:

20+ years of search behavior data

What people actually want

How they phrase questions

What results satisfy them

Personalization at unprecedented scale

You can't buy this data.

You can't replicate it.

You can't compete with it.

When Google's AI makes recommendations, it's based on billions of real user interactions.

That's a tough moat to beat.

🔟 Why institutional investors are quietly accumulating

Smart money doesn't follow headlines. It follows fundamentals.

What they're seeing:

Cheapest valuation in Big Tech

Strongest market position

Best AI infrastructure

Most defensible business model

Massive free cash flow generation

"Google has a very competitive offering and will battle for every point," says Jim Tierney, fund manager at AllianceBernstein.

The institutions know what retail investors missed:

Google isn't being disrupted. Google is doing the disrupting.

1️⃣1️⃣ The regulatory "problem" that's actually an opportunity

Yes, Google faces antitrust challenges.

But here's the contrarian view:

Forced Chrome sale: Reduces costs, maintains search dominance

Data sharing requirements: Levels playing field Google already wins

Market competition: Google's AI advantage only grows stronger

Regulation might actually force competitors to make Google's products better by giving them more data to train on.

Sometimes being too dominant is a high-quality problem.

1️⃣2️⃣ What the smart money is buying

Three groups of investors are accumulating Google:

Value investors: Cheapest Big Tech stock with fortress balance sheet

Growth investors: AI transformation just beginning, new revenue streams launching

Income investors: $70+ billion in annual free cash flow, growing dividend

The rare triple play: Value, growth, and income in one stock.

1️⃣3️⃣ The risks (because yes, every investment has them)

Let's be realistic about the downsides:

→Search behaviour change: People might use AI differently

→Regulation: Antitrust actions could impact business

→Competition: OpenAI or others could breakthrough

→Execution risk: AI integration might disappoint

But here's the key insight:

Every risk is already priced into a stock trading at 18x earnings.

The market assumes Google will struggle with AI.

The question i’m asking myself:

What if they dominate instead?

1️⃣4️⃣ What to watch as an investor

There’s a few metrics I think are important to watch for Google's AI transformation:

✅ AI Mode adoption rates: Higher usage = more revenue

✅ Search query growth: Still the core business driver

✅ Ad revenue per search: AI should improve this dramatically

✅ Subscription revenue: New high-margin business growing

✅ Cloud market share: Competing directly with Microsoft and Amazon

1️⃣5️⃣ The timeline that matters

Next 12 months:

AI Mode rollout globally

Subscription revenue growth

Search ad improvements

Next 2-3 years:

Project Mariner mainstream adoption

AR glasses product launch

Autonomous agents ecosystem

This isn't a 20-year bet on sci-fi technology.

This is a 2-year bet on the world's most profitable company getting more profitable with AI.

1️⃣6️⃣ Bottom line: Google is the ultimate AI value play

Parts of the market got it backwards.

AI startups are burning billions in cash, but they get all the hype.

In the mean time the market is ignoring the AI company that already prints money.

Google has:

The best AI technology (Gemini, DeepMind)

The biggest user base (billions of daily searches)

The strongest moat (decades of data)

The cheapest valuation (18x P/E vs peers at 28x+)

In a world where AI is everything, Google does more than survive

I see them as winning.

And I plan on profiting from it.

Want a portfolio that actually compounds wealth?

I find undervalued opportunities like Google while everyone else chases hype.

Simple, stable investments that work over time.

Follow for more plays parts of the market are choosing to ignore.

DISCLAIMER: This newsletter is for informational purposes only and is not intended as financial advice. The insights provided are illustrative and should not be the sole basis for investment decisions. Readers should conduct their own research and consult professional advisors before investing. The authors and publishers are not liable for any financial losses resulting from actions taken based on this content. Investing in the stock market involves risk, including potential loss of capital.