Don't let these 10 psychological biases control you - and your investing success

the Financial Education you need to succeed

Biases are such a big part of human nature.

They’re nearly impossible to avoid.

In fact if you believe they don’t affect you, you’re probably under a bias right now.

And understanding bias in the realm of investing is not merely an academic exercise; it's a fundamental cornerstone for success.

Our brains often lead us to make decisions based on emotion rather than rational analysis.

These inherent biases can distort our perception of risk, value, and potential, directly impacting the choices we make in the market.

By acknowledging and understanding these psychological tendencies, we can create strategies to counteract them, paving the way for more informed, objective, and successful investment choices.

—>to master the market, one must first master the mind.

So here are 10 psychological biases you need to know about:

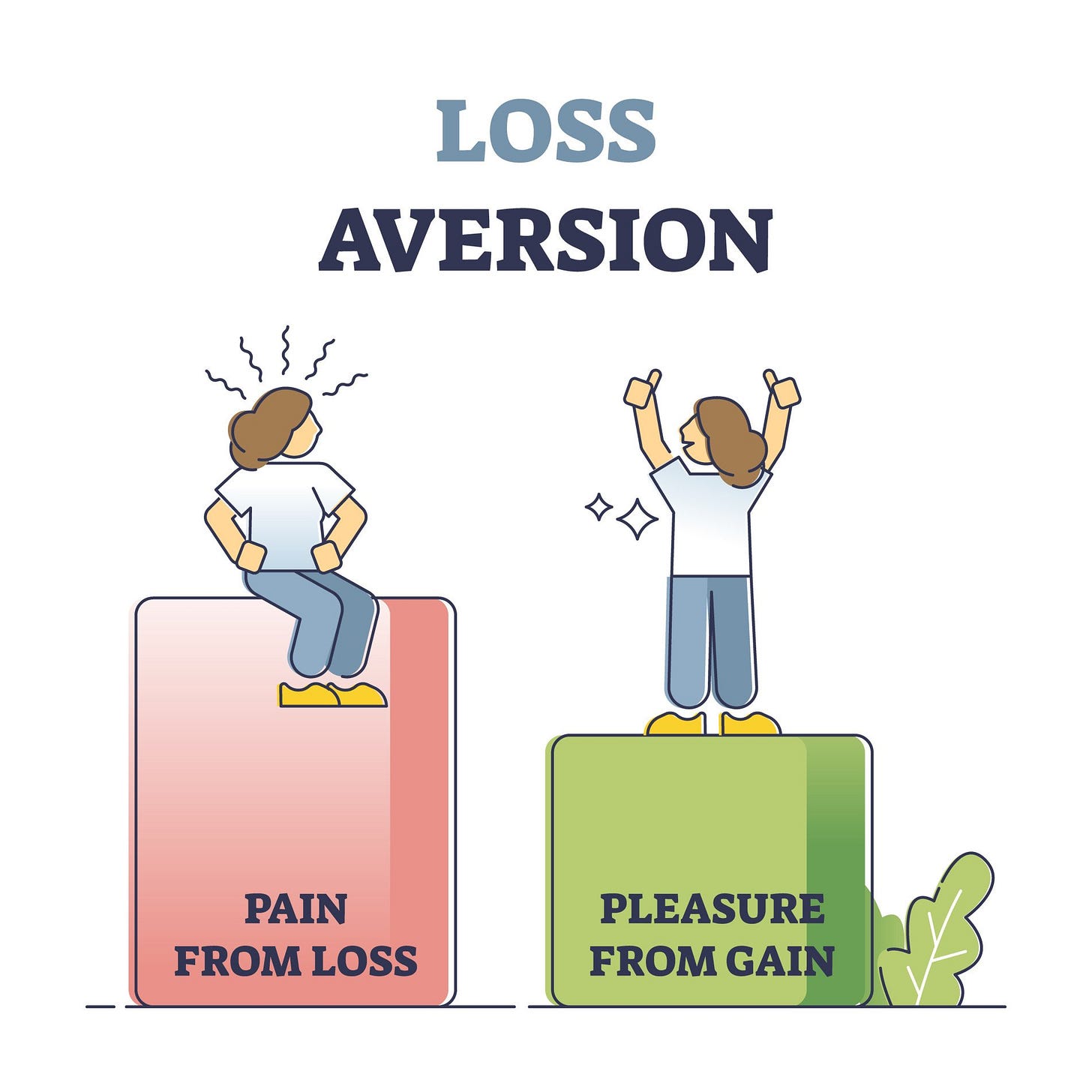

Loss Aversion

People tend to feel the pain of a loss more acutely than the pleasure of a gain. This can make investors overly cautious or cause them to hold onto losing investments for too long, hoping they'll rebound.

Example: Jane sells a winning stock early to lock in profits but holds onto a losing stock for months, hoping it will rebound.

Overconfidence Bias

Some investors may overestimate their abilities or the accuracy of their information. This can lead to excessive trading and risk-taking.

Example: After reading a few financial news articles, Bob believes he can consistently pick winning stocks, despite lacking in-depth knowledge.

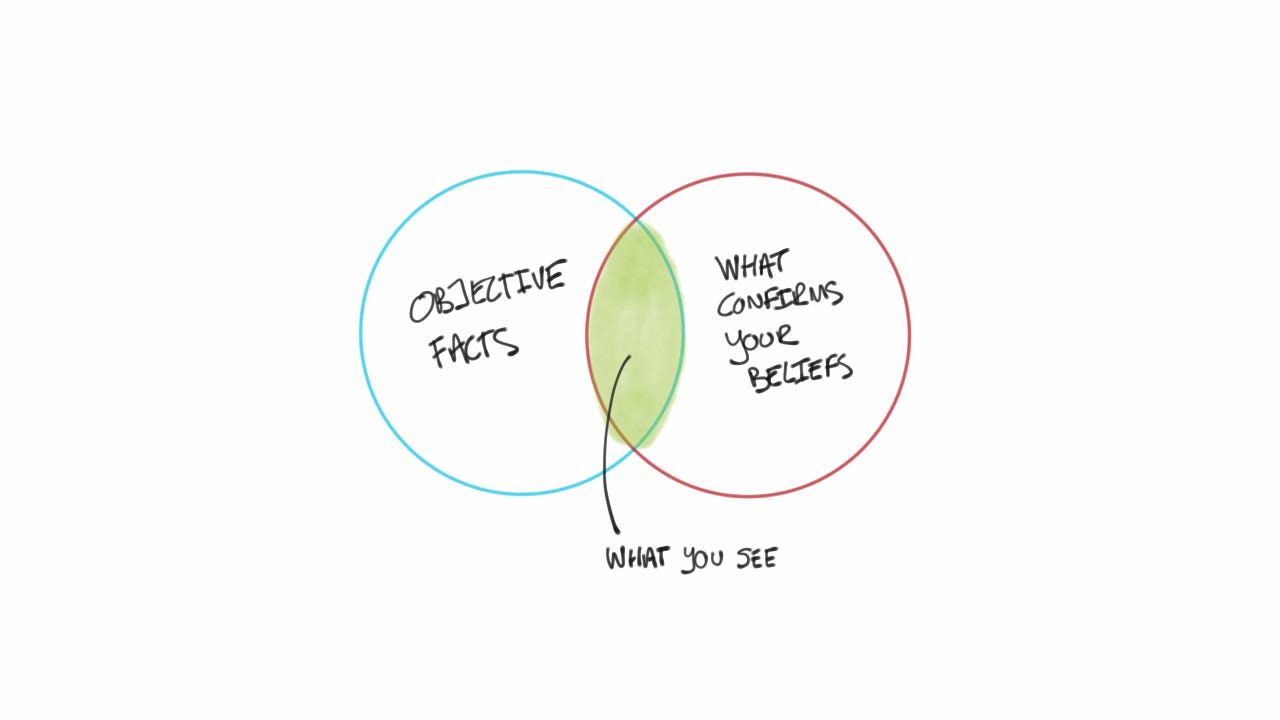

Confirmation Bias

People have a tendency to seek out and value information that confirms their pre-existing beliefs while ignoring or downplaying contradictory evidence. This can lead to a narrow perspective and missed investment opportunities.

Example: Emily reads only articles that support her belief in a certain company's growth and ignores reports suggesting potential risks.

Recency Bias

Investors might give more weight to recent events than to older ones. For instance, if the stock market recently crashed, an investor might be overly cautious, even if long-term data suggests that markets tend to recover over time.

Example: After seeing a tech stock plummet last week, Tom avoids all tech stocks, forgetting that they've been the market's best performers over the last decade.

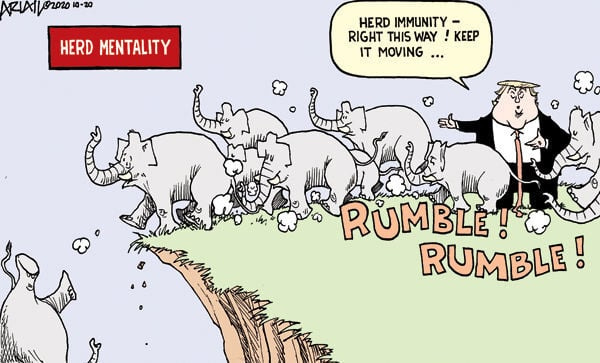

Herd Mentality

People often follow the crowd, especially in uncertain situations. If everyone is buying, they buy. If everyone is selling, they sell. This can inflate bubbles and deepen crashes.

Example: When everyone on financial TV is buying gold, Lisa buys too, even without understanding why gold might be a good investment.

Anchoring

This refers to the human tendency to rely heavily on the first piece of information encountered (the "anchor") when making decisions. If an investor first hears a stock is worth $100, they might anchor to this number, even if subsequent information suggests a different valuation.

Example: Mark hears that a stock's price is $50. Even after new data suggests it's overpriced, he still thinks it's a deal if it drops to $45.

Mental Accounting

Investors sometimes treat money differently depending on its source or intended use. For example, they might be more willing to take risks with "house money" (recent gains) than with their initial investment.

Example: Sarah treats her year-end bonus as "fun money" and takes bigger investment risks with it compared to her regular salary.

Availability Heuristic

People tend to base decisions on immediate, easily recalled information, rather than all available data. An investor might overreact to a recent news article while neglecting long-term trends.

Example: After hearing a news report on airline crashes, John avoids airline stocks, even though statistics show air travel is getting safer.

Endowment Effect

Once people own something, they tend to value it more highly than before they owned it. This can lead investors to hold onto assets longer than they should, simply because they own them.

Example: Kevin thinks the shares he owns are special and values them more than identical shares he doesn’t own.

Status Quo Bias

People have a natural inclination towards maintaining the current state of affairs. This can make investors resistant to change, leading them to stick with a particular investment strategy or asset even when evidence suggests it's time to adapt.

Example: Anna has always invested in bonds. Even when market data suggests stocks might offer better returns, she sticks with what she knows.

How to avoid the Bias Trap

Educate Yourself:

Stay informed about the basics of investing and the dynamics of the market.

Continuous learning helps understand the broader picture, making you less susceptible to short-term noise and biases.

Knowing about biases gives you control.

Establish and Stick to a Strategy:

Create a clear investment strategy based on your financial goals, risk tolerance, and timeline. This provides a framework to guide decisions, reducing the influence of emotions and biases.

Once you’ve found what works for you —> stick to it.

Regularly Review and Reflect:

Set aside time periodically (e.g., quarterly or annually) to review your portfolio.

This allows for objective evaluation, helping you recognize if and when emotional biases may have influenced decisions.

Be honest with yourself.

Seek Outside Perspectives:

Consult multiple information sources. Don’t just rely on one source of financial news.

Try and find articles that go against your opinion. See what they have to say. Get a complete picture.

Eager to dive deeper into the world of financial growth?

Subscribe to this newsletter for a regular dose of financial wisdom & actionable investing tips to complement your busy life.

It’s free and just a click away.

See you on the other side.