The Future is hard to predict.

But while predictions on the future are difficult, preparing for it is not.

If you’re an investor, being informed on what the future might look like is essential.

So in this issue we will go through some of the most common future investor errors you can expect - and we’ll get you thinking on how to avoid them.

1. Over-reliance on AI and Automation

AI is fantastic for data analysis, but it's not perfect. It can't always catch the subtle signals in the market like a human can.

If you rely too much on technology, you might miss out on crucial insights or misinterpret your data.

Remember, AI is a tool, not a replacement for your own analytical skills.

2. Ignoring Traditional Investment Wisdom

New investment strategies are exciting, but don't let them overshadow the tried-and-true methods like diversification.

This means not putting all your eggs in one basket.

It's especially important now, as markets and investment products are constantly evolving.

Combining new ideas with classic strategies can help protect your investments from unexpected risks.

3. Underestimating the Impact of Climate Change

Climate change is changing the game for many industries.

If you're not considering how it might affect your investments, you could be putting your money into sectors that might face big disruptions or new regulations in the future.

This could lead to a drop in the value of your investments.

4. Overconfidence in Emerging Technologies

Investing in the latest tech can be tempting, but it's risky if you don't fully understand it.

New tech changes fast, and so can its success in the market.

If you put too much into these unproven areas, you might lose out if they don't take off as expected.

5. Neglecting Global Economic Shifts

The world's economies are all connected.

Ignoring changes in emerging markets or global politics might limit your investment options and increase your risks.

Staying aware of these trends can help you spot new opportunities and avoid losses from unexpected events.

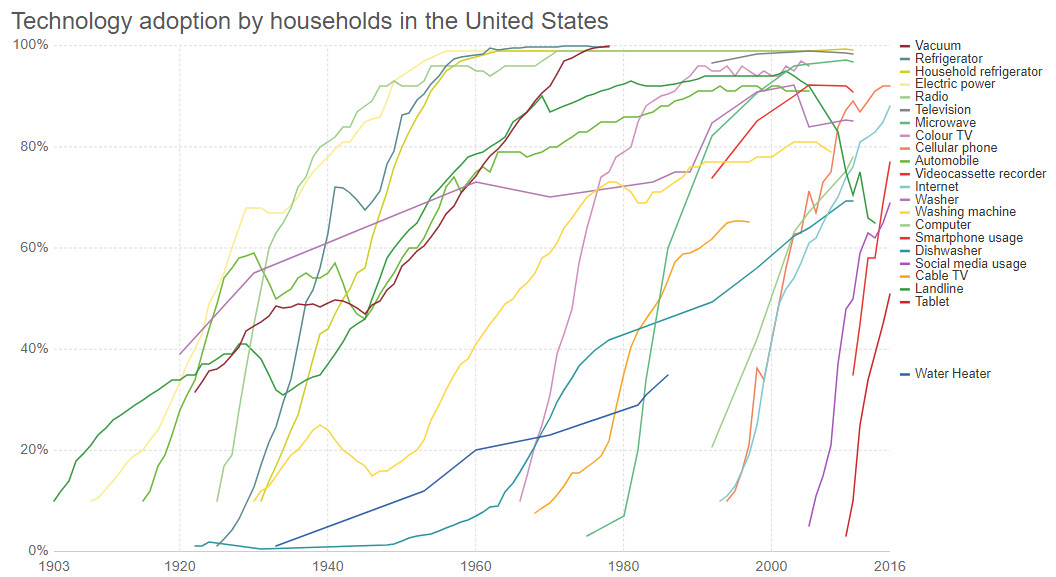

6. Misjudging the Rate of Technological Adoption

It's hard to predict how quickly new technologies will catch on.

Getting it wrong can mean jumping into investments too early, when the tech isn't ready, or missing the boat on a great opportunity.

A miscalculation here could mean missing out on profits or facing losses.

7. Failure to Adapt to Regulatory Changes

Laws, especially around digital assets and privacy, are constantly changing.

If you're not keeping up, you might end up breaking rules or missing out on chances to make good investments.

This could lead to legal problems or a decrease in the value of your investments.

8. Overlooking Cybersecurity Risks

As more finance stuff moves online, the risk of cyber threats increases.

If you're not thinking about these risks when you make investment decisions, you could be leaving your money open to things like hacking or fraud, which can lead to big financial losses.

9. Chasing Short-term Trends

It's easy to get caught up in the hype of short-term trends, but they don't always line up with real, solid market basics.

If you focus too much on these fleeting trends, you might make risky, impulsive investments.

This can lead to big losses instead of the steady, long-term growth you want.

10. Neglecting Personal Financial Health

Chasing high returns is exciting, but not if it means you're ignoring your own financial security.

If you're not balancing your investments with things like emergency funds or managing debt, you could end up in a tough spot.

Keeping an eye on your personal financial health is key to making sure your investment risks don't threaten your overall stability.

Summary:

1. Overreliance on AI and Automation

2. Ignoring Traditional Investment Wisdom

3. Underestimating the Impact of Climate Change

4. Overconfidence in Emerging Technologies

5. Neglecting Global Economic Shifts

6. Misjudging the Rate of Technological Adoption

7. Failure to Adapt to Regulatory Changes

8. Overlooking Cybersecurity Risks

9. Chasing Short-term Trends

10. Neglecting Personal Financial Health

Stay informed and adapt to the changing world of investing.

Subscribe (for free) for continued insights and guidance.

Reach out if you have any questions!

Best regards,

InvestiMate