Sleep Better at Night: 3 Investments for a Rock-Solid Portfolio Core

#38 A Young Professionals Weekly Investing Insights

Whether you're just starting your investment journey or you're looking to optimise your existing portfolio, today’s article is for you.

When it comes to investing today, finding the right balance between simplicity, performance, and peace of mind can seem like an impossible task.

At least it did for me - for a long time.

But what if there was a way to build a robust, high-performing portfolio without the stress and complexity?

Enter three powerhouse ETFs that can form the backbone of a resilient investment strategy for both beginners and more seasoned investors.

And today we’ll explore how these ETFs can help you generate more wealth confidently and stress-free.

I know ETFs can sound boring - and it’s true. They’re not as spicy as individual stocks.

But boring works incredibly well and it gives you a strong reliable core for your portfolio and returns.

And as you’ll see in a bit - this strategy still lets experiment with other investment types so just stick with us.

The Investing Challenge: Where Do You Fit In?

If you're new to investing, you might be feeling:

Overwhelmed by the sheer number of investment options

Worried about making costly mistakes with your hard-earned money

Unsure where to start or how to build a diversified portfolio

If you're a more experienced investor, you might be:

Seeking ways to optimise your portfolio for better performance

Looking to reduce overall portfolio volatility

Interested in simplifying your investment strategy without sacrificing returns

Regardless of your experience level, you probably share these common concerns:

Wanting to maximise returns while minimising risk

Desiring a "set it and forget it" approach that doesn't require constant monitoring

Aiming to build a portfolio that can weather market storms and economic uncertainties

These are all valid concerns. The good news?

There's a straightforward solution that can address all of these worries.

Meet Your New Investing Allies: SCHD, VTI, and VT

These three ETFs aren't just investments – they're the building blocks of a resilient, high-performing portfolio.

But before we dive in, let's address the question you're probably asking:

Why should you trust these ETFs with your hard-earned money when so many other options exist?

Well here are some cold, hard facts for you:

🚀Performance That Puts Others to Shame🚀

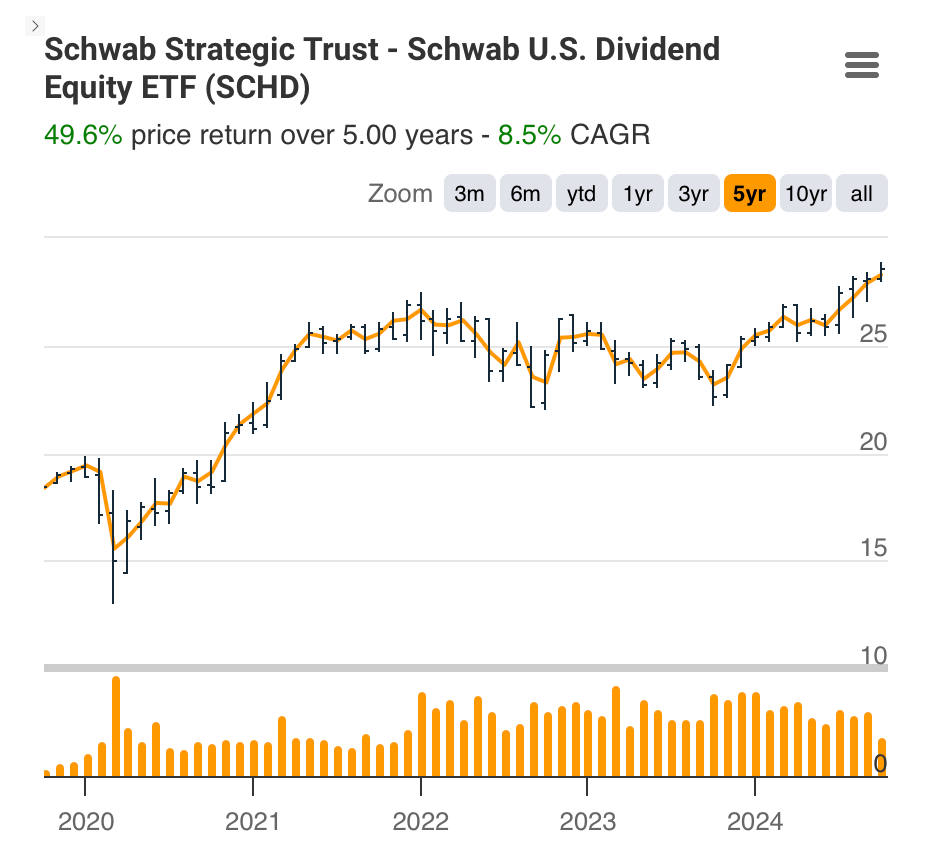

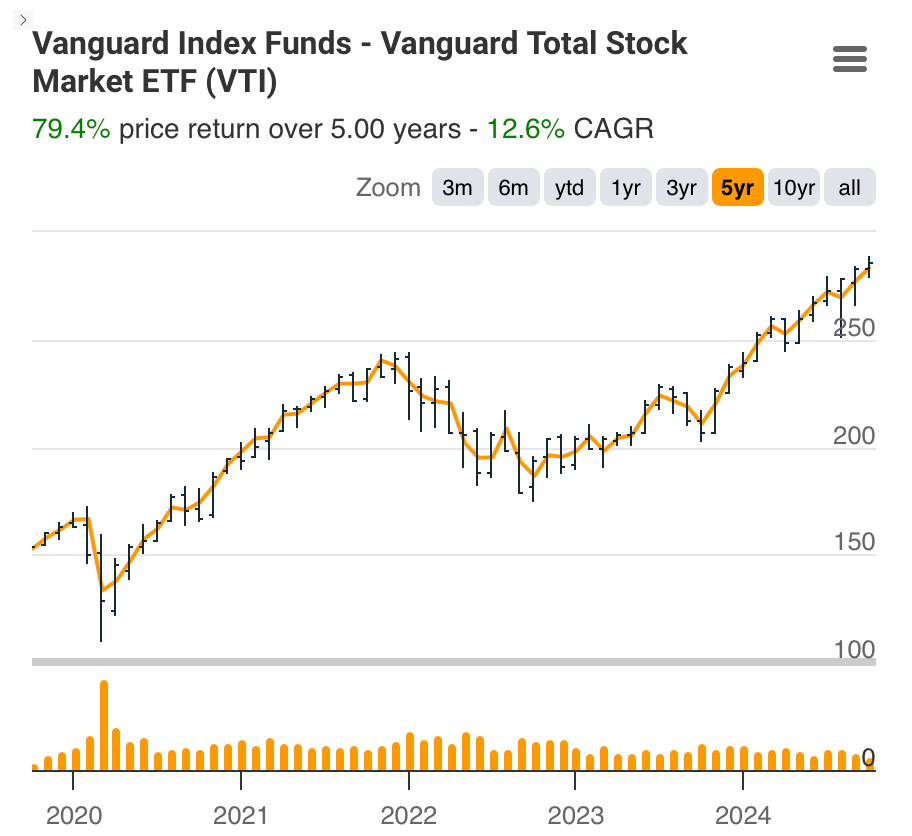

VTI has delivered an average annual return of 12.6% over the past 5 years.

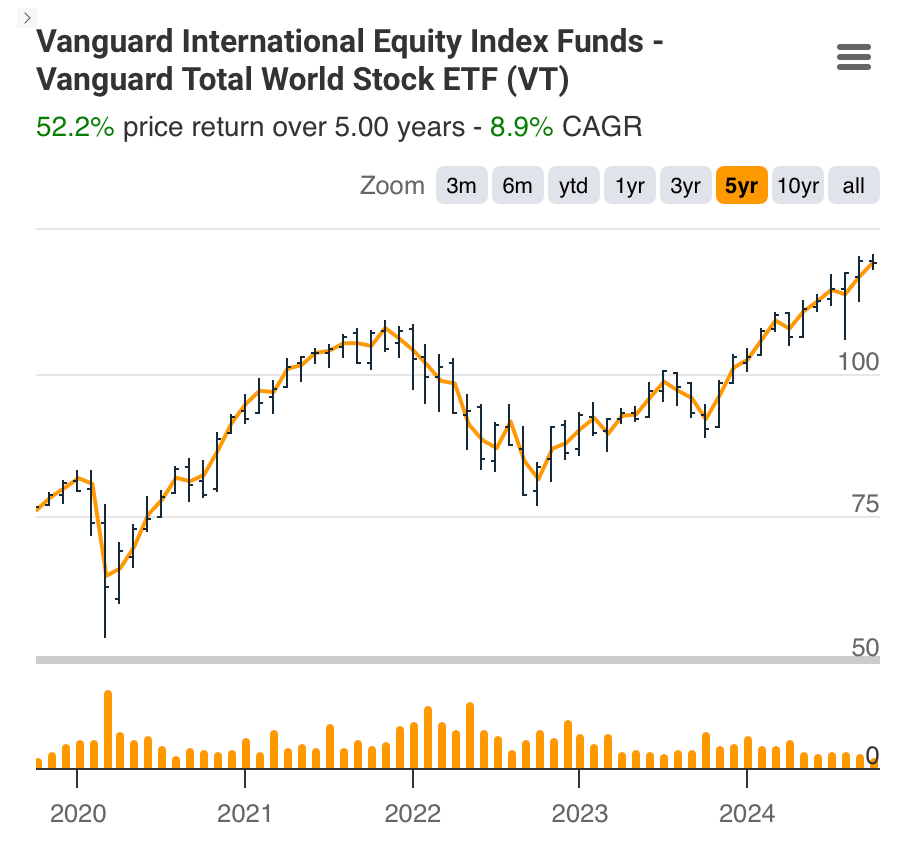

VT isn't far behind, with a 9% 5-year average annual return

SCHD, while younger, has impressed with a 8.5% average annual return over the past 5 years.

Compare this to the average actively managed fund - which consistently underperforms these indexes.

To put this in context - according to S&P Dow Jones Indices, over a 15-year period, 92% of large-cap funds failed to beat the S&P 500.💪Battle-Tested in Market Armageddon💪

During the 2020 COVID crash, when the world seemed to be ending:

VTI and VT both dropped about 34% but recovered within 5 months

SCHD fell 35% but bounced back even faster, in just 4 months

Meanwhile - many individual stocks took a lot longer to recover - if they recovered at all. Think companies in the travel sector like Carnival Corp (CCL) or American Airlines (AAL). 🛡️Your Shield Against Volatility🛡️

In 2022, when the S&P 500 fell 18% and tech stocks crashed, SCHD only dipped 3.4%. Yep - that’s right.

And VTI and VT's broad diversification means no single stock disaster could sink your entire portfolio

Got your attention?

Let's now dive deeper into what makes these ETFs your secret weapon against market madness.

The Power of Three: Understanding Your Arsenal

SCHD (Schwab U.S. Dividend Equity ETF)

This ETF focuses on steady income and lower risk.

It includes 100 U.S. companies that pay reliable dividends. These are also companies that tend to have strong financial health. You'll find big names like Novo Nordic, Nestle, and LVMH here.

It's spread across different sectors:

18% in banks and financial companies

18% in consumer goods companies

17% in industrial companies

16% in healthcare companies

It costs very little to own: just $6 per year for every $10,000 invested (0.06% expense ratio)

It’s unique strength? SCHD's emphasis on quality dividend stocks provides a steady income stream and acts as a buffer during market downturns. Its focus on companies with strong cash flows and consistent dividend growth which makes it particularly resilient in various economic conditions.

VTI (Vanguard Total Stock Market ETF)

This ETF gives you a piece of the entire U.S. stock market.

It holds over 3,700 different companies.

These range from huge corporations to small, growing businesses. Top companies include familiar names like Apple, Microsoft, and Amazon.

It's divided into sectors like this:

30% in technology companies

13% in financial companies

12% in healthcare businesses

It's also super cheap to own: only $3 per year for every $10,000 invested (0.03% expense ratio)

What makes it different? VTI's broad market exposure captures the growth potential of emerging sectors and smaller companies that might be overlooked in large-cap focused funds. This basically makes it well-positioned to benefit from future economic trends and innovations across all market segments.

VT (Vanguard Total World Stock ETF)

This ETF gives you exposure to the entire global stock market.

It includes companies from the U.S. and around the world, both developed and emerging markets.

Its holdings are more diverse than VTI and cover international markets:

About 60% in U.S. companies Around 40% in international companies

Its sector breakdown is similar to VTI, but with more global diversity:

24% in technology firms

15% in financial companies

11% in healthcare companies

11% in industrial companies

10% in consumer discretionary businesses

It does cost slightly more than VTI: $8 per year for every $10,000 invested (0.08% expense ratio). Is that a lot for ETFs? Definitely not so rest assured.

And it's unique strength? VT's global diversification provides exposure to international growth opportunities and acts as a hedge against U.S. market downturns. It will give you a truly worldwide investment approach.

Performance in Diverse Economic Conditions

The thing is - you should understand how these ETFs perform in different economic scenarios.

Why?

Because it can help you appreciate their collective strength:

→so by combining these ETFs you create a portfolio that's well-equipped to handle various economic conditions.

How to Use These ETFs: Keeping It Simple

The beauty of these ETFs is that you don't need to choose just one.

You can mix and match to create a portfolio that suits your needs.

Here are a couple of easy options:

The "Keep It Super Simple" Approach: 100% VTI

One fund that gives you the entire U.S. stock market

This could be ideal for beginners who want maximum simplicity

The "Balanced Beginner" Strategy: 50% VTI, 50% SCHD

Combines broad market exposure with steady dividend-paying companies

For those who want a mix of growth potential and some steady income - this can be good for you

I for myself own have 25% of my portfolio in SCHD and 25% in VT. I don’t feel the need to invest in all three - and would rather include a few more risky bets (thematic ETFs and 2-3 individual stocks).

Just remember: these are just starting points and you can change your allocation as you grow more confident.

The 50% Solution: Your Path to Investing Zen

Here's the game-changer - Allocating just 50% of your portfolio to a combination of these ETFs can:

Capture the lion's share of market gains

Dramatically reduce your portfolio's volatility

Free you from the tyranny of constant market watching

And here's the thing:

You still have 50% left to explore other opportunities or keep as a cash reserve.

Imagine the freedom of knowing half your portfolio is rock-solid - giving you the confidence to take calculated risks with the rest (I’m thinking individual stocks, sector or thematic ETFs, alternative assets, etc…)

Your Action Plan: From Stress to Success

Take a deep breath. You can do this.

Review your current portfolio. How does it compare to the stability these ETFs offer?

Choose your ideal mix of SCHD, VTI, and VT based on your goals.

Start shifting funds today. Even a small start is a step towards peace of mind.

Set up automatic investments. Let your financial fortress build itself.

Use the remaining funds for targeted investments or keep as a safety net.

Sleep soundly, knowing you've built an unshakeable financial foundation.

Sound good?

The Million-Dollar Question

I want you to ask yourself:

How much is peace of mind worth to you?

How much would you pay to never lose sleep over your investments again?

With SCHD, VTI, and VT, that priceless peace of mind comes with some of the lowest fees in the industry.

To me it wasn’t just an investment in stocks - it's an investment in my financial well-being.

So act now, invest wisely, and reclaim your financial peace of mind.

The market waits for no one - but with these ETFs, you'll be ready for whatever it throws your way.

Ready to take your investing journey to the next level?

Whenever you’re ready, here's how I can help:

"How to Grow Your Money Effortlessly with High-Performing ETFs": My comprehensive guide for busy professionals who want to build wealth without the stress of stock-picking.

Learn how to:

Create a high-performing ETF portfolio in less than a day

Select ETFs that provide safety and are future-ready

Automate your investments for truly hands-off wealth building

Plus, get exclusive access to:

Custom ETF Portfolio Tracker

An ETF Selection Checklist

Market Downturn Survival Guide

Private community of like-minded investors

and 11+ other bonus resources (including access to 16+ free investing ebooks).

Don't let another day pass watching your savings stagnate.

Join thousands of readers who are already on their path to financial freedom.

[Click here to get started today and save 70% with our special subscriber discount!]

Oh and here are some other newsletters I enjoy reading and recommend:

This newsletter is for informational purposes only and is not intended as financial advice. The insights provided are illustrative and should not be the sole basis for investment decisions. Readers should conduct their own research and consult professional advisors before investing. The authors and publishers are not liable for any financial losses resulting from actions taken based on this content. Investing in the stock market involves risk, including potential loss of capital.

I'm not sure I understand why the article stars with these three: SCHD, VTI and VOO, then continues with these three: SCHD, VTI and VT. Why the change from VOO to VT? These two are quite different...

At the end of the article we're back at SCHD, VTI and VOO.

Did I miss something?

👍👍