Let me explain my ETF portfolio strategy - I've designed it to be both intelligent and straightforward, combining stability with growth potential.

I'll break down exactly why I chose each component and how it all works together.

My Core Foundation

Think of it as the Engine Room:

I start with VTI (about 30% of my portfolio) as my core holding.

Why? It's like owning a tiny piece of basically every important American company all at once.

From Apple and Microsoft to smaller growing companies - I own them all.

It's my safety net, my foundation. The best part? It only costs me 0.03% per year to hold it. That's like paying just 30 cents for every $1,000 invested - practically nothing!

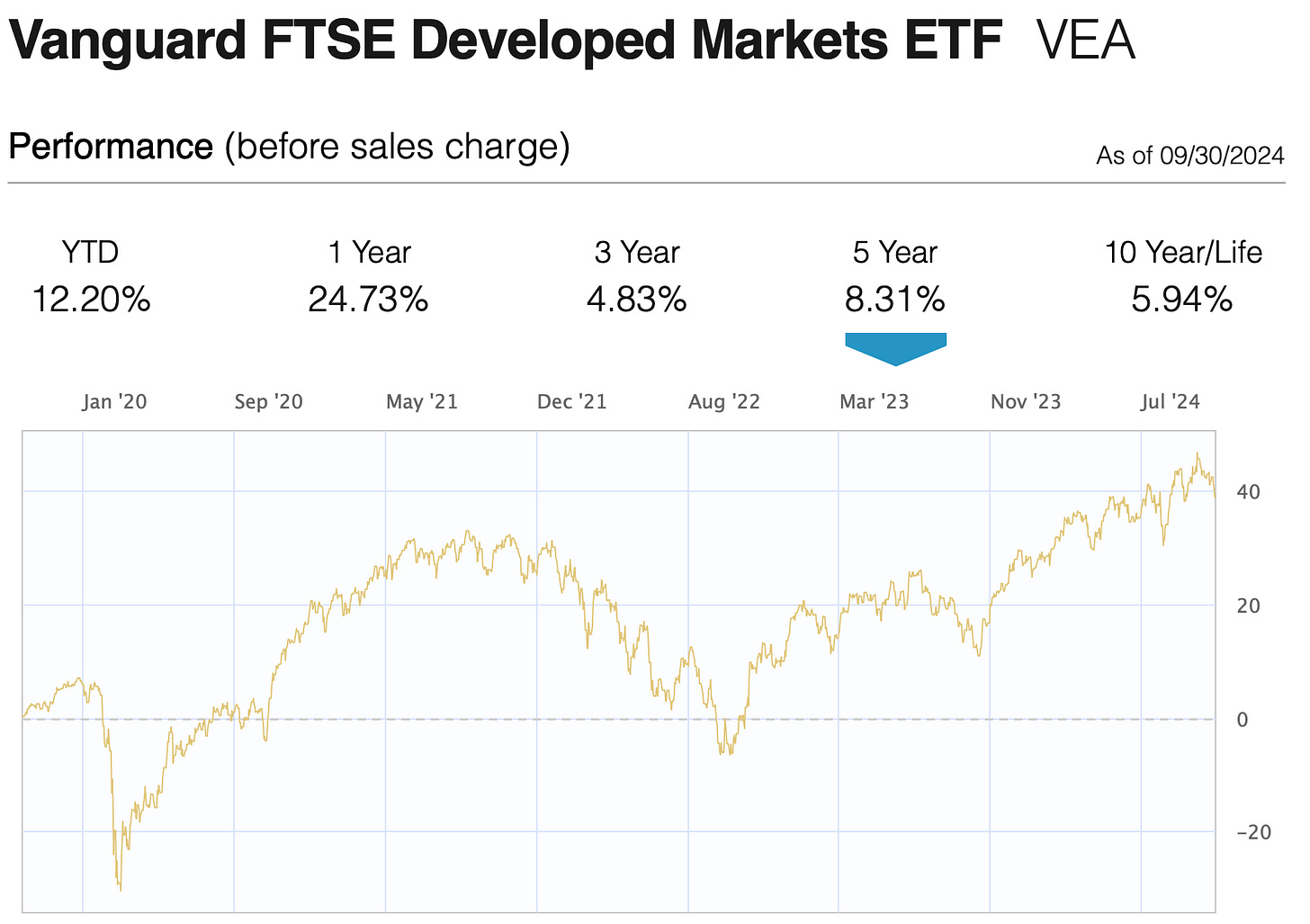

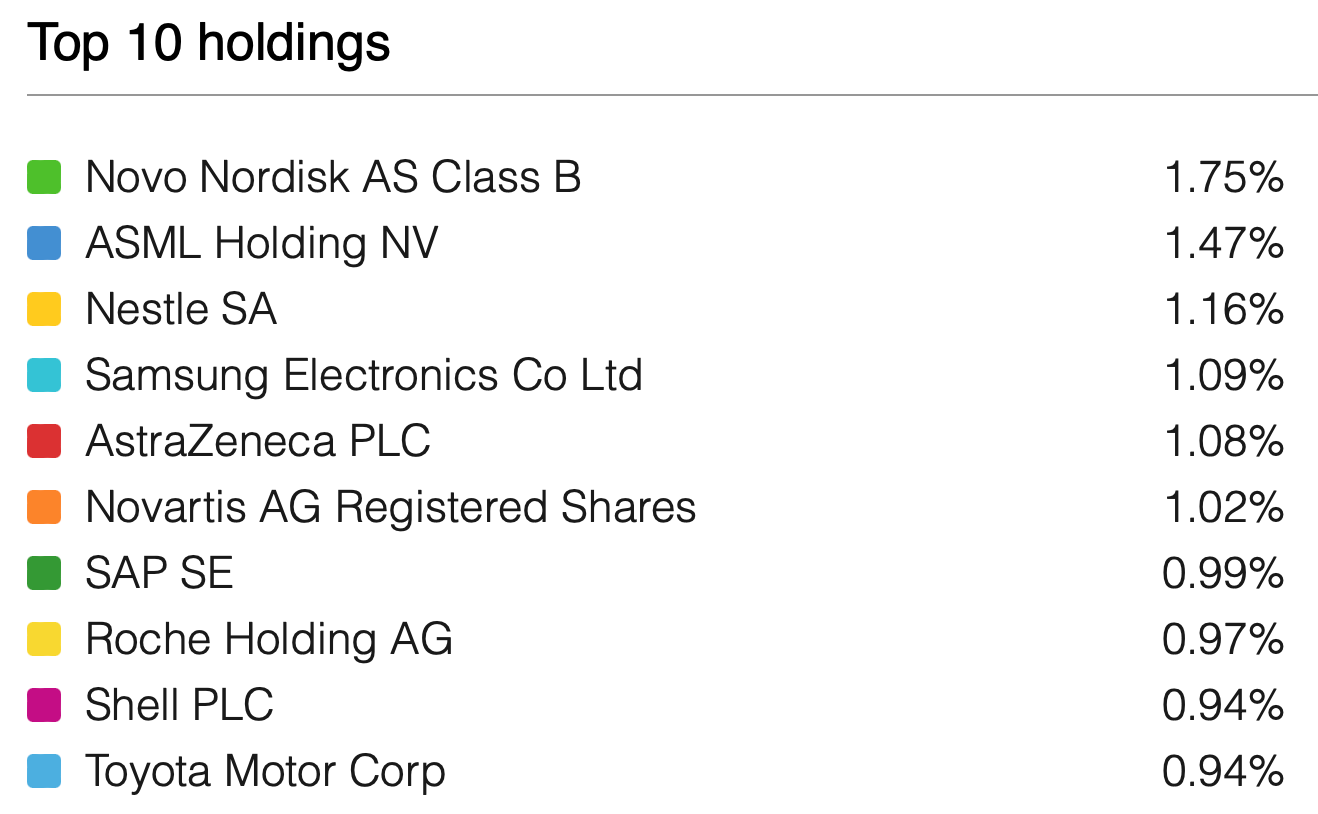

Next up is VEA (about 30%) - my international shield.

Look, I love the US market, but I'm not putting all my eggs in one basket.

VEA gives me ownership in successful companies from Japan to Germany to the UK and beyond.

When the US market might be having a rough time, these international companies might be thriving.

It's like having a backup generator for my investment house.

And again, super cheap to hold at just 0.06%.

Now, Here's Where It Gets Really Interesting:

My Growth Engines:

Cybersecurity Play (CIBR - 10%)

Think about it - every single day we hear about another cyber attack or data breach. Every company, government, and organization NEEDS cybersecurity. It's not optional anymore.

That's why I have CIBR in my portfolio.

These companies aren't just growing - they're becoming essential to modern business. So I’m just investing in the digital security of the future.

Technology Powerhouse (VGT - 15%)

I'm not just betting on today's tech giants - I'm investing in the entire technological revolution.

VGT gives me exposure to everything from cloud computing to artificial intelligence to whatever comes next.

Every industry is becoming a tech industry, and VGT puts me right in the middle of that transformation.

The 0.10% expense ratio is tiny considering the growth potential.

Healthcare Fortress (VHT - 15%)

Here's a fact that no one can argue with - people will always need healthcare.

With aging populations worldwide and incredible medical innovations happening, healthcare isn't just a safe bet - it's a growth story too.

VHT gives me exposure to everything from established pharmaceutical companies to cutting-edge biotech firms. The 1.36% dividend is just icing on the cake.

Why I Love This Strategy (and Why It Makes So Much Sense for You Too):

It's Like Having Multiple Insurance Policies:

If US stocks struggle, my international holdings might shine

If the market gets rocky, healthcare tends to stay stable

If inflation hits hard, tech companies can often raise prices easily

If there's a crisis, cybersecurity becomes even more important

I'm Riding Multiple Unstoppable Trends:

Digital transformation (Tech)

Aging global population (Healthcare)

Rising cybersecurity threats (CIBR)

Global economic growth (VTI + VEA)

I'm Being Smart About Costs: Most of my money is in super low-cost funds. Why? Because every dollar I don't pay in fees is a dollar that stays in my portfolio working for me. It's like getting a head start in a race.

I'm Getting Paid While I Wait: Several of these ETFs pay dividends. That means I'm getting regular income just for holding them. It's like collecting rent on my investments.

I Can Sleep at Night: This portfolio is diversified enough that I don't worry about any single company or sector tanking my investments, but it's focused enough that I can still capture significant growth.

The Beauty of My Approach:

I'm not trying to get rich overnight or make wild bets.

Instead, I've built a portfolio that:

Captures the overall growth of the US and global economy

Taps into the most promising trends of our time

Protects me from putting too many eggs in one basket

Keeps costs super low

Generates some nice dividend income

Lets me sleep well at night

This isn't just a random collection of ETFs - it's a carefully thought-out strategy that gives me exposure to the stable core of the market while also positioning me to benefit from some of the most powerful trends shaping our future.

Whether the market is up or down, I know my portfolio is built to weather the storms and capture the growth opportunities ahead.

Want to know what I love most about this setup?

I don't have to constantly watch the market or make trades. I can just let this portfolio do its thing, rebalance occasionally, and focus on my life while my money works for me.

It's investing made simple, but smart.

Staying Ahead of the Game

While this core-satellite strategy forms the foundation of my approach, I'm always scanning the horizon for emerging trends and market shifts.

Markets evolve rapidly, and new opportunities emerge constantly.

That's why I actively review and update my portfolio allocation.

When I spot promising new sectors or themes (like how I added CIBR after identifying cybersecurity as a critical standalone industry), I'm ready to adjust. I'm currently watching potential opportunities in areas like:

Artificial Intelligence

Clean Energy

Space Technology

Quantum Computing

Biotech Breakthroughs

Rise of China

Following my newsletter and portfolio updates gives you:

Real-time alerts when I make strategic changes

Analysis of why I'm adding or removing positions

Insights into emerging trends I'm watching

Early access to my thoughts on market-moving events

The portfolio you see today is strong, but it's not static.

I do the heavy lifting of research and analysis, and my followers benefit from that work.

Stay connected through my newsletter to ensure you never miss an update or new opportunity - the future is always evolving, and so is my strategy.

Disclaimer: I'm sharing my personal investment strategy and portfolio choices based on my own research and objectives. While I aim to provide valuable insights, this isn't financial advice. Every investor has different goals, risk tolerance, and circumstances. Past performance doesn't guarantee future results, and all investing carries risk of loss.

The ETFs mentioned are those I personally invest in - I don't receive any compensation from fund providers or financial institutions for mentioning them. The expense ratios, allocations, and statistics mentioned were accurate at time of writing but may change.

Before making any investment decisions, please:

Do your own research

Consider consulting with a financial advisor

Review each fund's prospectus

Evaluate how these investments fit your personal financial goals and risk tolerance

Understand that ETF prices and market conditions fluctuate

My portfolio and strategy may change without notice. For the most current updates, please subscribe to my newsletter.

Tax laws and regulations vary by location and individual circumstances. Nothing in my analysis should be considered tax or legal advice.

Remember: The best investment strategy is one you can stick with through market cycles while sleeping well at night.